When it comes to managing finances, understanding the intricacies of financial institutions like Ally Financial is crucial. Ally Financial has carved out a niche for itself as a trusted provider of financial services, including auto loans and refinancing options. If you're looking for the Ally Financial overnight payoff address, you've come to the right place. This article will explore everything you need to know about this topic, from the basics to advanced strategies.

Ally Financial has become a household name in the financial world, offering competitive rates and flexible terms for borrowers. Whether you're paying off a car loan or refinancing your existing debt, knowing the correct payoff address can save you time, money, and hassle. This guide aims to provide clarity and actionable insights.

In today's fast-paced financial landscape, having accurate information at your fingertips is essential. This article will delve into the specifics of Ally Financial's overnight payoff address, ensuring you have all the tools necessary to manage your financial obligations effectively. Let's dive in!

Read also:Amc Classic Pensacola 18 Your Ultimate Moviegoing Experience

Table of Contents

- Overview of Ally Financial

- Understanding the Ally Financial Overnight Payoff Address

- Why Use Overnight Payoff?

- Ally Financial's Background and History

- Steps to Obtain Your Payoff Amount

- Tips for Paying Off Your Loan Efficiently

- Common Questions About Payoff Addresses

- Ensuring Secure Transactions

- Alternative Payment Methods

- Conclusion and Next Steps

Overview of Ally Financial

Ally Financial, originally established as GMAC Financial Services, has evolved into one of the leading financial institutions in the United States. Known for its robust online banking services and innovative financial products, Ally caters to a wide range of customers, from individual borrowers to large corporations.

One of the key services offered by Ally is its auto loan program, which includes refinancing options and flexible repayment terms. Understanding the workings of Ally Financial is essential for anyone seeking to manage their loans effectively.

Key Features of Ally Financial

- Competitive interest rates

- Flexible repayment options

- 24/7 customer support

- Secure online platforms

Understanding the Ally Financial Overnight Payoff Address

The Ally Financial overnight payoff address is a critical piece of information for borrowers looking to settle their loans quickly and efficiently. This address is specifically designed for overnight deliveries, ensuring that your payoff request reaches Ally Financial in a timely manner.

By using the correct payoff address, you can avoid delays and ensure that your payment is processed without any hiccups. Below is the official overnight payoff address for Ally Financial:

Ally Financial

PO Box 380901

Minneapolis, MN 55438-0901

Why the Payoff Address Matters

Using the correct payoff address is crucial because it directly impacts the speed and accuracy of your transaction. Incorrect or outdated addresses can lead to delays, which may result in additional fees or penalties.

Read also:Is James Charles Still Alive Unveiling The Truth Behind The Viral Sensation

Why Use Overnight Payoff?

Opting for an overnight payoff service offers several advantages, especially when dealing with time-sensitive financial transactions. Here are some reasons why you should consider using overnight delivery:

- Speed: Overnight delivery ensures that your payment reaches Ally Financial within 24 hours.

- Reliability: Trusted courier services minimize the risk of lost or delayed payments.

- Peace of Mind: Knowing that your payment will arrive on time can alleviate stress and uncertainty.

Ally Financial's Background and History

Ally Financial Inc. was founded in 1919 as the General Motors Acceptance Corporation (GMAC). Over the decades, it has grown into a diversified financial services company, offering a wide range of products and services.

In 2006, GMAC rebranded itself as Ally Financial to reflect its expanded focus beyond automotive financing. Today, Ally operates as a fully digital bank, providing customers with seamless banking experiences.

Biographical Highlights

| Year Founded | 1919 |

|---|---|

| Headquarters | Detroit, Michigan |

| CEO | Jeff Brown |

| Revenue (2022) | $10.1 billion |

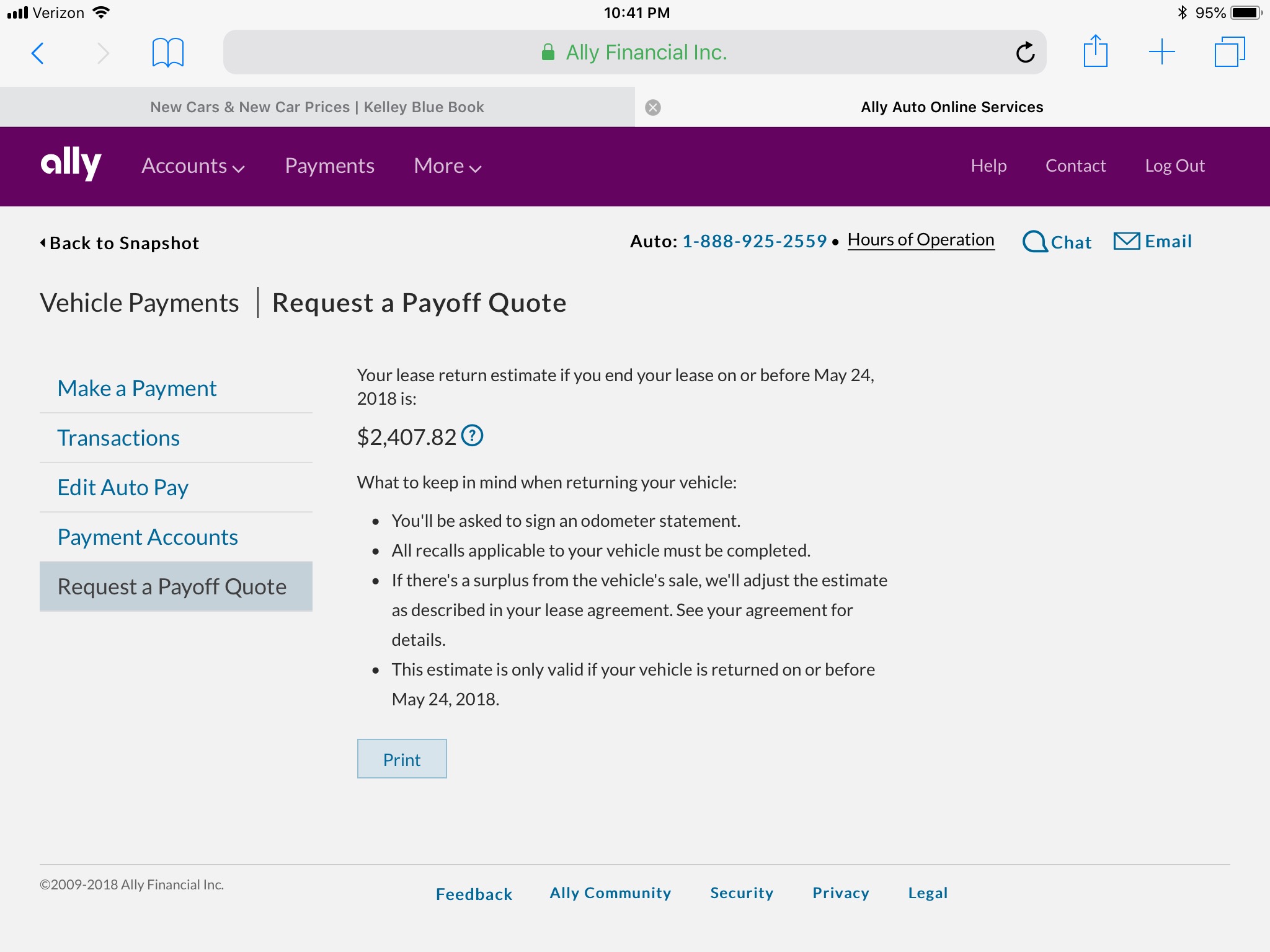

Steps to Obtain Your Payoff Amount

Before sending your payment to the Ally Financial overnight payoff address, it's essential to determine your exact payoff amount. Follow these steps to ensure accuracy:

- Log in to your Ally Financial account online.

- Access the "Loan Payoff" section in your account dashboard.

- Request a payoff statement, which will include the total amount due and any applicable fees.

Additional Considerations

When calculating your payoff amount, consider the following factors:

- Prepayment penalties (if applicable)

- Interest accrued up to the payoff date

- Any outstanding fees or charges

Tips for Paying Off Your Loan Efficiently

Paying off your loan early can save you money in the long run. Here are some tips to help you pay off your loan efficiently:

- Create a budget to allocate funds specifically for your loan repayment.

- Consider refinancing your loan for better terms if interest rates have dropped.

- Make extra payments whenever possible to reduce the principal balance.

Financial Planning Strategies

Effective financial planning is key to managing your loans successfully. Work with a financial advisor to develop a comprehensive plan that aligns with your long-term goals.

Common Questions About Payoff Addresses

Here are some frequently asked questions about Ally Financial's overnight payoff address:

Q1: Can I use regular mail instead of overnight delivery?

While you can use regular mail, it may take longer for your payment to reach Ally Financial. Overnight delivery ensures faster processing times.

Q2: What happens if I send my payment to the wrong address?

If your payment is sent to the wrong address, it may result in delays or lost payments. Always double-check the address before sending your payment.

Ensuring Secure Transactions

Security is paramount when handling financial transactions. Ally Financial employs advanced encryption technologies to protect your personal and financial information. Additionally, using trusted courier services for overnight delivery adds an extra layer of security.

Best Practices for Secure Transactions

- Verify the authenticity of the payoff address before sending your payment.

- Use secure payment methods, such as certified checks or money orders.

- Keep records of all transactions for future reference.

Alternative Payment Methods

While overnight delivery is a popular choice, Ally Financial offers several alternative payment methods:

- Online payments through your Ally Financial account

- Bank transfers

- Wire transfers

Choose the method that best suits your needs and ensures timely payment processing.

Conclusion and Next Steps

In conclusion, understanding the Ally Financial overnight payoff address is essential for anyone looking to settle their loans efficiently. By following the steps outlined in this guide, you can ensure that your payment is processed without any delays or complications.

We encourage you to take action by verifying your payoff amount and preparing your payment for delivery. Don't hesitate to reach out to Ally Financial's customer support team if you have any questions or concerns.

Feel free to share this article with others who may benefit from the information provided. For more insights into financial management, explore our other articles and resources. Together, let's build a financially secure future!

![Ally Auto Overnight Payoff Address [FREE ACCESS]](https://overnightaddressfinder.com/wp-content/uploads/2024/04/Ally-Auto-Overnight-Payoff-Address.jpg)