The Virginia Department of Taxation, commonly referred to as the VA Dept of Taxation, plays a pivotal role in managing the financial health of the state. It oversees tax regulations, administers tax programs, and ensures compliance among residents and businesses. Whether you're a taxpayer, business owner, or simply someone interested in understanding how state taxation works, this article will provide you with an in-depth look at the VA Dept of Taxation.

The VA Dept of Taxation is a critical entity for anyone living or operating a business in Virginia. Understanding its functions and responsibilities can help individuals and organizations navigate the complexities of state taxes effectively. This article aims to demystify the workings of the department and provide actionable insights.

From individual income taxes to corporate taxes, the VA Dept of Taxation touches every aspect of financial life in Virginia. By exploring its history, functions, and current initiatives, we aim to empower readers with the knowledge they need to stay compliant and informed.

Read also:Santa Clarita Population 2023 An Indepth Analysis And Insights

Table of Contents

- Introduction to the VA Dept of Taxation

- A Brief History of the VA Dept of Taxation

- Key Functions of the VA Dept of Taxation

- Types of Taxes Administered by the VA Dept of Taxation

- The Tax Filing Process in Virginia

- Ensuring Tax Compliance

- Resources and Tools Provided by the VA Dept of Taxation

- Challenges Faced by the VA Dept of Taxation

- Future Initiatives and Innovations

- Conclusion and Call to Action

Introduction to the VA Dept of Taxation

The VA Dept of Taxation serves as the primary authority responsible for tax administration in the Commonwealth of Virginia. Established to manage and enforce tax laws, it ensures that all residents and businesses contribute fairly to the state's revenue. This section will delve into the foundational aspects of the department and its significance in the state's fiscal framework.

Understanding the Role of the VA Dept of Taxation

The department's primary role is to administer tax programs, including individual income tax, corporate income tax, sales and use tax, and various other excise taxes. By doing so, it ensures that the state has the necessary funds to support public services, infrastructure, and education. The VA Dept of Taxation also plays a crucial role in educating taxpayers about their obligations and rights.

Importance in State Governance

As a cornerstone of state governance, the VA Dept of Taxation contributes significantly to the state's financial stability. It collaborates with other government agencies to ensure seamless tax collection and distribution of funds. This collaboration helps maintain transparency and accountability in state finances.

A Brief History of the VA Dept of Taxation

The VA Dept of Taxation has a rich history that dates back to the early days of Virginia's statehood. Established to manage the growing complexity of tax laws, the department has evolved over the years to meet the changing needs of the state. This section will explore its origins and key milestones.

Key Milestones

- Establishment of the department in the early 20th century.

- Introduction of electronic filing systems in the 1990s.

- Expansion of services to include online resources and mobile applications.

Key Functions of the VA Dept of Taxation

The VA Dept of Taxation performs several critical functions that are essential for maintaining the state's financial health. These functions include tax collection, enforcement, and administration. Let's take a closer look at each of these areas.

Read also:Is James Charles Still Alive Unveiling The Truth Behind The Viral Sensation

Tax Collection

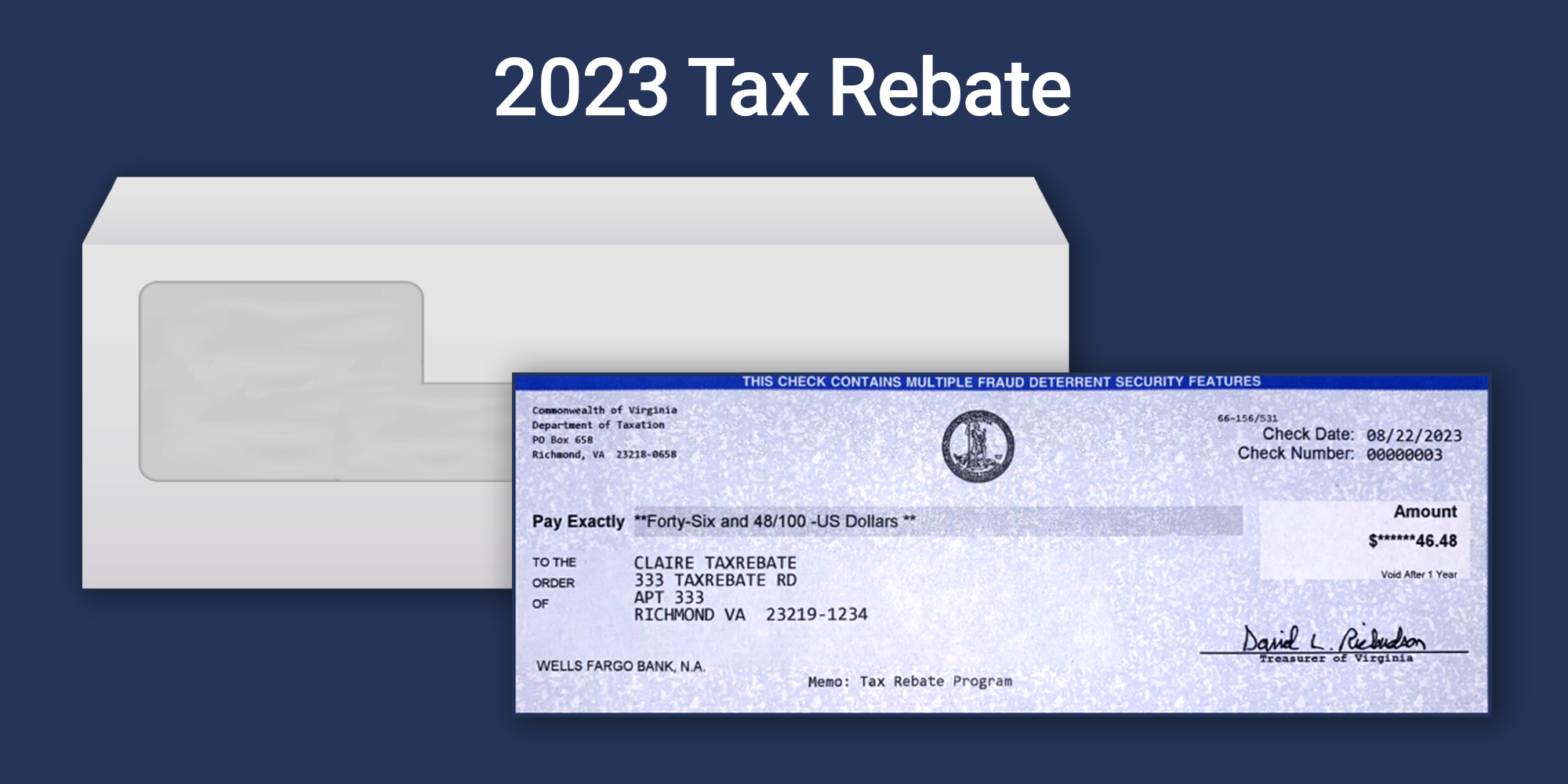

One of the primary functions of the department is to collect taxes from individuals and businesses. This includes processing tax returns, issuing refunds, and managing tax payments. The department employs a team of skilled professionals to ensure accuracy and efficiency in tax collection.

Tax Enforcement

To ensure compliance, the VA Dept of Taxation enforces tax laws through audits, investigations, and penalties for non-compliance. This enforcement helps maintain a level playing field for all taxpayers and ensures that everyone contributes their fair share.

Types of Taxes Administered by the VA Dept of Taxation

The VA Dept of Taxation administers a variety of taxes, each with its own set of rules and regulations. Understanding these taxes is crucial for both individuals and businesses. Below is a breakdown of the major tax categories:

Individual Income Tax

This tax applies to all residents of Virginia and is based on their annual income. The VA Dept of Taxation provides resources to help taxpayers calculate and file their income tax returns accurately.

Corporate Income Tax

Businesses operating in Virginia are subject to corporate income tax. The department offers guidance on tax calculations and filing procedures to assist businesses in meeting their tax obligations.

The Tax Filing Process in Virginia

Filing taxes in Virginia can be a straightforward process if you understand the steps involved. The VA Dept of Taxation provides several options for filing, including online and paper-based methods. This section will outline the filing process and provide tips for a smooth experience.

Steps for Filing Taxes

- Gather all necessary documents, such as W-2 forms and income statements.

- Choose your filing method (online or paper-based).

- Complete the tax return form accurately and submit it by the deadline.

Ensuring Tax Compliance

Tax compliance is essential for maintaining a fair and equitable tax system. The VA Dept of Taxation offers resources and tools to help taxpayers stay compliant. This section will discuss the importance of compliance and the consequences of non-compliance.

Consequences of Non-Compliance

Failing to comply with tax laws can result in penalties, interest charges, and legal action. The VA Dept of Taxation encourages taxpayers to seek assistance if they encounter difficulties in meeting their tax obligations.

Resources and Tools Provided by the VA Dept of Taxation

The VA Dept of Taxation provides a wealth of resources and tools to assist taxpayers. These include online calculators, FAQs, and customer service support. This section will highlight some of the most useful resources available.

Online Resources

The department's website offers a range of online tools, including tax calculators, e-filing options, and a comprehensive FAQ section. These resources are designed to make tax filing easier and more accessible for all taxpayers.

Challenges Faced by the VA Dept of Taxation

Like any government agency, the VA Dept of Taxation faces several challenges. These include managing the increasing complexity of tax laws, ensuring taxpayer privacy, and adapting to technological advancements. This section will explore these challenges and the department's efforts to address them.

Technological Advancements

Embracing technology is crucial for the VA Dept of Taxation to improve efficiency and enhance taxpayer services. The department continues to invest in digital solutions to streamline processes and enhance security.

Future Initiatives and Innovations

The VA Dept of Taxation is committed to innovation and continuous improvement. Future initiatives include expanding online services, enhancing data security, and implementing new technologies to improve the taxpayer experience. This section will provide insights into these upcoming developments.

Expanding Online Services

As more taxpayers prefer digital solutions, the department plans to expand its online services to include features such as mobile apps and chatbots. These innovations aim to make tax filing more convenient and accessible for all users.

Conclusion and Call to Action

In conclusion, the VA Dept of Taxation plays a vital role in the financial well-being of Virginia. By understanding its functions and resources, taxpayers can better navigate the complexities of state taxes. We encourage readers to utilize the department's resources and stay informed about tax regulations.

We invite you to share your thoughts and experiences in the comments section below. Additionally, feel free to explore other articles on our site for more insights into financial and tax-related topics. Together, let's build a community of informed and compliant taxpayers.

References:

- Virginia Department of Taxation Official Website

- IRS Guidelines for State Tax Administration

- Statistical Data from the Virginia State Government