Dealing with potential fraud can be a stressful and overwhelming experience, but knowing the right resources to contact can make all the difference. If you're a customer of Fifth Third Bank and suspect fraudulent activity, it's crucial to know the Fifth Third Bank fraud department number to protect your accounts and finances. In this comprehensive guide, we’ll explore everything you need to know about the fraud department, including how to contact them, what steps to take if you suspect fraud, and tips for safeguarding your financial information.

Fifth Third Bank is one of the largest financial institutions in the United States, serving millions of customers across multiple states. As part of their commitment to customer security, the bank has established a dedicated fraud department to address concerns and assist customers in resolving issues related to unauthorized transactions or suspicious activity.

This article will provide you with actionable insights, practical advice, and reliable information to help you navigate potential fraud situations effectively. By the end of this guide, you’ll feel more confident in understanding how to protect your accounts and resolve any issues that may arise.

Read also:Understanding The Security And Functionality Of Https Aka Ms Remoteconnect Com

Table of Contents

- Introduction to Fifth Third Bank Fraud Department

- Fifth Third Bank Fraud Department Number

- Steps to Take If You Suspect Fraud

- How to Report Fraud to Fifth Third Bank

- Fraud Protection Services Offered by Fifth Third Bank

- Customer Support Options for Fraud

- Tips for Preventing Fraud

- Common Types of Financial Fraud

- Legal Protections Against Fraud

- Conclusion

Introduction to Fifth Third Bank Fraud Department

Fifth Third Bank's fraud department plays a critical role in ensuring the security of its customers' financial information. The department is equipped with trained professionals who specialize in identifying and resolving fraudulent activities. Whether you've noticed unauthorized transactions on your account or suspect someone is using your personal information, the fraud department is your first line of defense.

Why Is the Fraud Department Important?

The importance of the fraud department cannot be overstated. In today's digital age, financial fraud is a growing concern. Cybercriminals are constantly finding new ways to exploit vulnerabilities in financial systems, making it essential for banks to have robust measures in place to protect their customers.

How Does the Fraud Department Operate?

The fraud department at Fifth Third Bank operates around the clock to monitor accounts for suspicious activity. They use advanced algorithms and data analytics to detect potential fraud in real-time. If any unusual transactions are flagged, the department will reach out to the account holder to verify the activity.

Fifth Third Bank Fraud Department Number

Knowing the Fifth Third Bank fraud department number is crucial if you suspect fraudulent activity on your account. The official number to contact the fraud department is 1-800-545-4842. This number is available 24/7 to assist customers with any fraud-related concerns.

When Should You Call?

- If you notice unauthorized transactions on your account.

- If you suspect someone has accessed your personal information.

- If you receive a notification from the bank about suspicious activity.

Steps to Take If You Suspect Fraud

If you suspect fraud, it's important to act quickly to minimize potential damage. Here are the steps you should take:

1. Contact the Fraud Department

Call the Fifth Third Bank fraud department number immediately to report the issue. The sooner you report the fraud, the better chance you have of resolving the issue quickly.

Read also:Explore Walnut Creek Movie Theater Your Ultimate Movie Experience

2. Freeze Your Account

If you believe your account has been compromised, you can request a temporary freeze on your account to prevent further unauthorized transactions.

3. Monitor Your Accounts

Regularly check your bank statements and transaction history for any suspicious activity. This will help you catch any potential fraud early.

How to Report Fraud to Fifth Third Bank

Reporting fraud to Fifth Third Bank is a straightforward process. Here’s what you need to do:

1. Gather Information

Before calling the fraud department, gather all relevant information, including transaction details, account numbers, and any correspondence related to the suspected fraud.

2. Call the Fraud Department

Use the official fraud department number to speak with a representative. Be prepared to provide details about the suspected fraud and answer security questions to verify your identity.

3. Follow Up

After reporting the fraud, follow up with the bank to ensure the issue is being addressed. Keep a record of all communications for your reference.

Fraud Protection Services Offered by Fifth Third Bank

Fifth Third Bank offers several fraud protection services to help customers safeguard their accounts. These include:

- Account Alerts: Receive notifications for unusual transactions or account activity.

- Identity Theft Protection: Access resources to help protect your identity and resolve issues related to identity theft.

- Secure Online Banking: Use advanced security features to protect your online banking experience.

How Effective Are These Services?

These fraud protection services are designed to provide an additional layer of security for customers. While no system is foolproof, they significantly reduce the risk of fraud and help customers detect issues early.

Customer Support Options for Fraud

In addition to the fraud department, Fifth Third Bank offers multiple customer support options to assist with fraud-related issues. These include:

1. Online Chat Support

Customers can access live chat support through the Fifth Third Bank website to address fraud concerns.

2. Mobile App Support

The Fifth Third Bank mobile app provides tools for monitoring accounts and reporting suspicious activity.

3. Email Support

For non-urgent issues, customers can contact the bank via email for assistance.

Tips for Preventing Fraud

Preventing fraud starts with being proactive and vigilant. Here are some tips to help you protect your financial information:

1. Secure Your Personal Information

Never share sensitive information such as passwords, Social Security numbers, or account details with anyone.

2. Use Strong Passwords

Create complex passwords for your online accounts and update them regularly.

3. Monitor Your Accounts

Regularly review your account statements and transaction history for any suspicious activity.

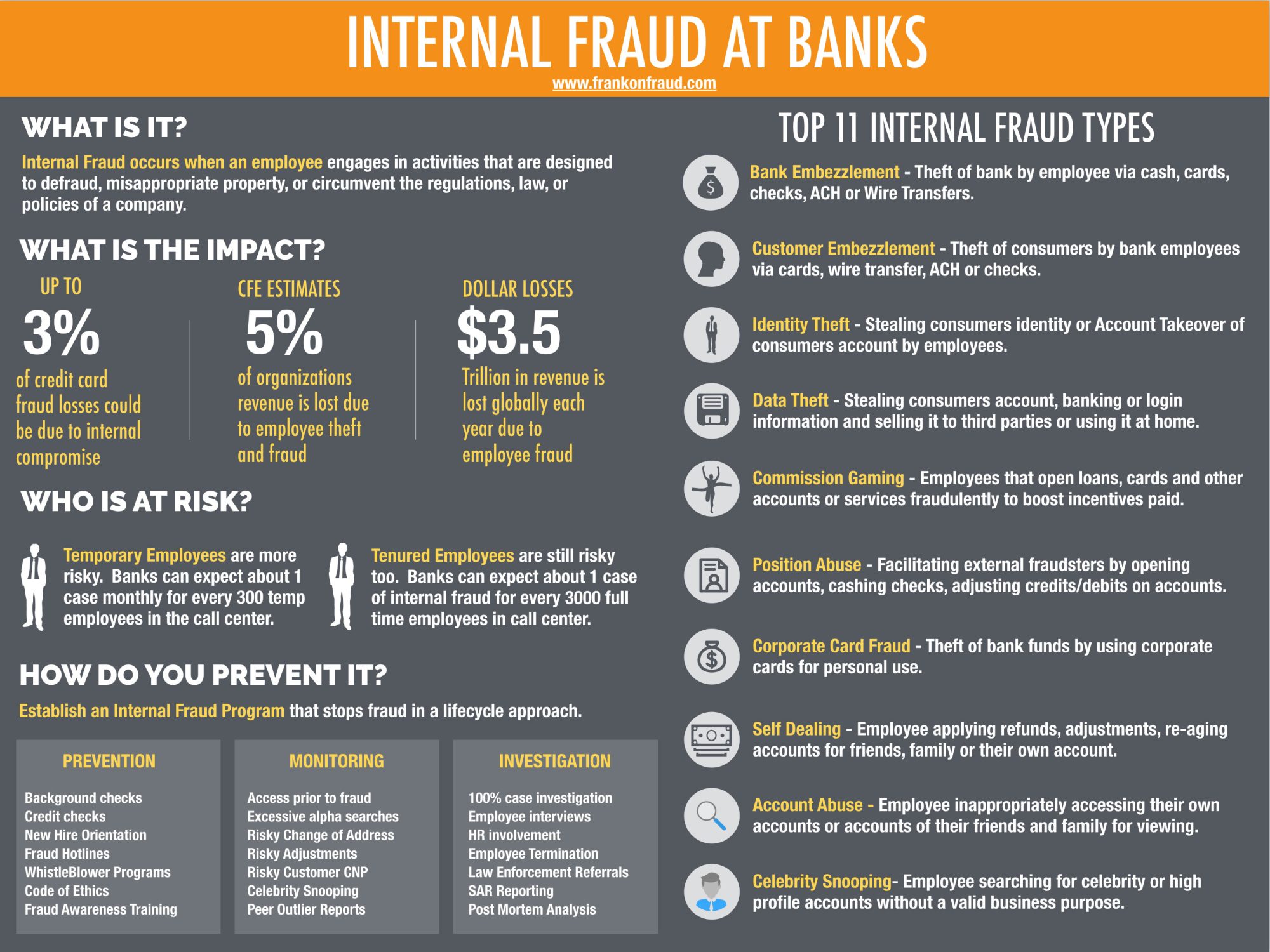

Common Types of Financial Fraud

Understanding the different types of financial fraud can help you recognize potential threats. Some common types of fraud include:

1. Identity Theft

Occurs when someone uses your personal information to open accounts or make purchases in your name.

2. Credit Card Fraud

Involves unauthorized use of your credit card information for purchases or cash advances.

3. Phishing Scams

Scammers attempt to trick you into revealing sensitive information through fake emails or websites.

Legal Protections Against Fraud

There are several legal protections in place to help victims of financial fraud. These include:

1. The Fair Credit Billing Act

Provides protection against unauthorized credit card charges and billing errors.

2. The Electronic Fund Transfer Act

Offers protection for unauthorized electronic transactions.

3. State Laws

Many states have additional laws in place to protect consumers from fraud.

Conclusion

Fifth Third Bank's fraud department is a vital resource for customers concerned about the security of their accounts. By knowing the Fifth Third Bank fraud department number and following the steps outlined in this guide, you can take proactive measures to protect your finances and resolve any issues that may arise.

We encourage you to share this article with others who may benefit from the information. If you have any questions or comments, feel free to leave them below. Stay informed and stay safe!

References:

1. Fifth Third Bank Official Website

2. Federal Trade Commission

3. Consumer Financial Protection Bureau