When it comes to financial security, knowing the Fifth Third Bank fraud phone number is crucial. Many individuals face challenges in identifying legitimate channels to report fraudulent activities. This article aims to provide a detailed guide on how to protect yourself and your finances from potential threats.

In today's digital age, financial fraud has become increasingly sophisticated. Cybercriminals use various tactics to deceive unsuspecting victims, making it essential to stay informed and vigilant. Understanding the resources available, such as the Fifth Third Bank fraud phone number, can make a significant difference in safeguarding your assets.

This article will explore everything you need to know about Fifth Third Bank's fraud reporting process, including the phone number, steps to take if you suspect fraud, and preventive measures. By the end, you'll have a clear understanding of how to protect yourself and your finances effectively.

Read also:Capital One Customer Service Number Your Ultimate Guide To Seamless Banking Support

Table of Contents

- Introduction

- Fifth Third Bank Fraud Reporting Process

- How to Contact Fifth Third Bank for Fraud

- The Fifth Third Bank Fraud Phone Number

- Common Types of Fraud to Watch Out For

- Preventing Fraud: Tips and Best Practices

- Understanding Identity Theft

- Steps to Take If You Suspect Fraud

- Fifth Third Bank Customer Support

- Conclusion

Fifth Third Bank Fraud Reporting Process

Reporting fraud to Fifth Third Bank involves a systematic process designed to ensure your account's security. The bank offers multiple channels for reporting suspicious activities, including the Fifth Third Bank fraud phone number. Here's a breakdown of the steps you should follow:

First, gather all relevant information about the suspected fraud. This includes transaction details, dates, and any communication you've had with unauthorized parties. Next, contact Fifth Third Bank immediately using their designated fraud reporting channels.

Once you've reported the issue, the bank will initiate an investigation. During this time, they may freeze your account temporarily to prevent further unauthorized transactions. It's crucial to cooperate fully with the bank's fraud team to resolve the matter swiftly.

Why Prompt Reporting Matters

- Prompt reporting increases the likelihood of recovering lost funds.

- It helps the bank identify and address vulnerabilities in their systems.

- You contribute to a safer financial environment for all customers.

How to Contact Fifth Third Bank for Fraud

Contacting Fifth Third Bank for fraud-related issues can be done through various methods. The most direct approach is using the Fifth Third Bank fraud phone number. However, the bank also provides online reporting tools and email support for added convenience.

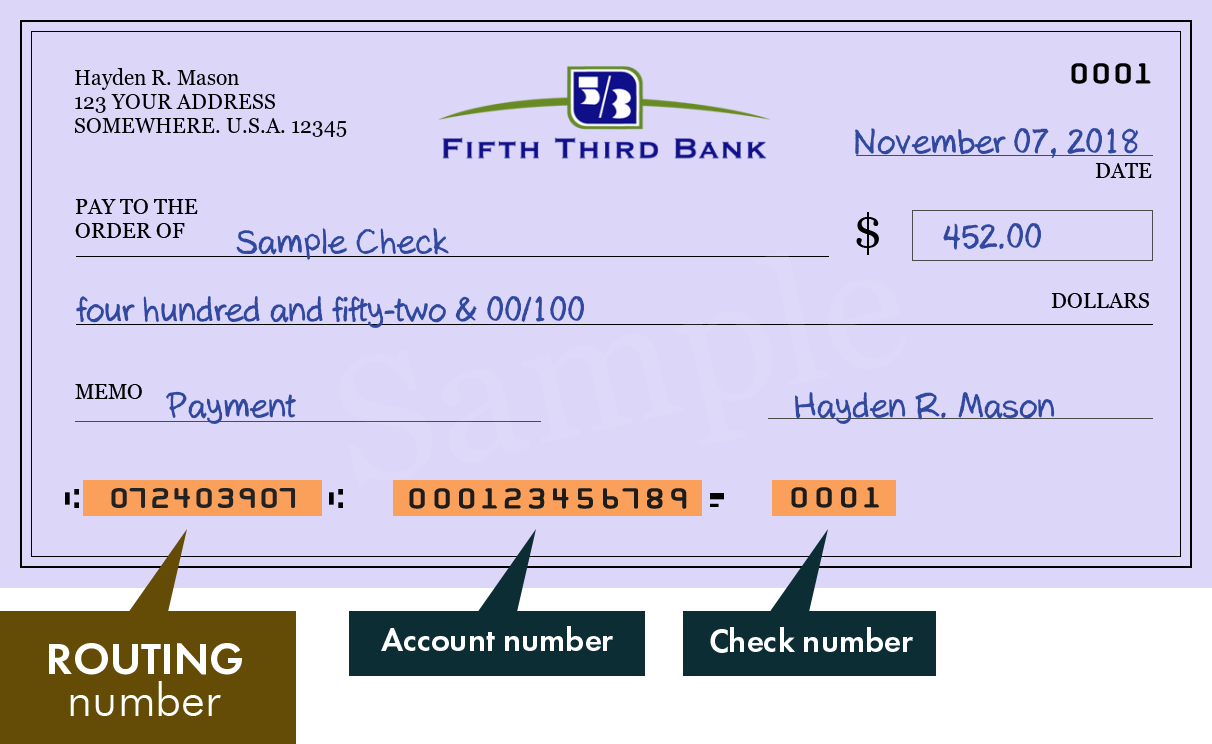

When calling the fraud phone number, ensure you have all necessary details at hand. This includes your account number, recent transaction history, and any communication you've had with suspected fraudsters. The more information you provide, the easier it will be for the bank to assist you.

Additional Contact Options

- Online Reporting: Use Fifth Third Bank's secure online portal to file a fraud report.

- Email Support: Send an email to the designated fraud department for non-urgent matters.

- In-Person Assistance: Visit your nearest Fifth Third Bank branch for personalized support.

The Fifth Third Bank Fraud Phone Number

The Fifth Third Bank fraud phone number is a critical resource for customers who suspect fraudulent activity on their accounts. This dedicated line ensures that your concerns are addressed promptly and efficiently. The phone number is typically available 24/7, allowing you to report issues at any time.

Read also:Plain White Ts Members The Story Behind The Bands Success

While the exact number may vary depending on your location, Fifth Third Bank provides clear instructions on their official website for contacting their fraud department. Always verify the phone number through official channels to avoid falling victim to scams.

What to Expect When Calling

- You'll speak with a trained fraud specialist who will guide you through the reporting process.

- Be prepared to answer security questions to verify your identity.

- Provide detailed information about the suspected fraud to assist the specialist in resolving the issue.

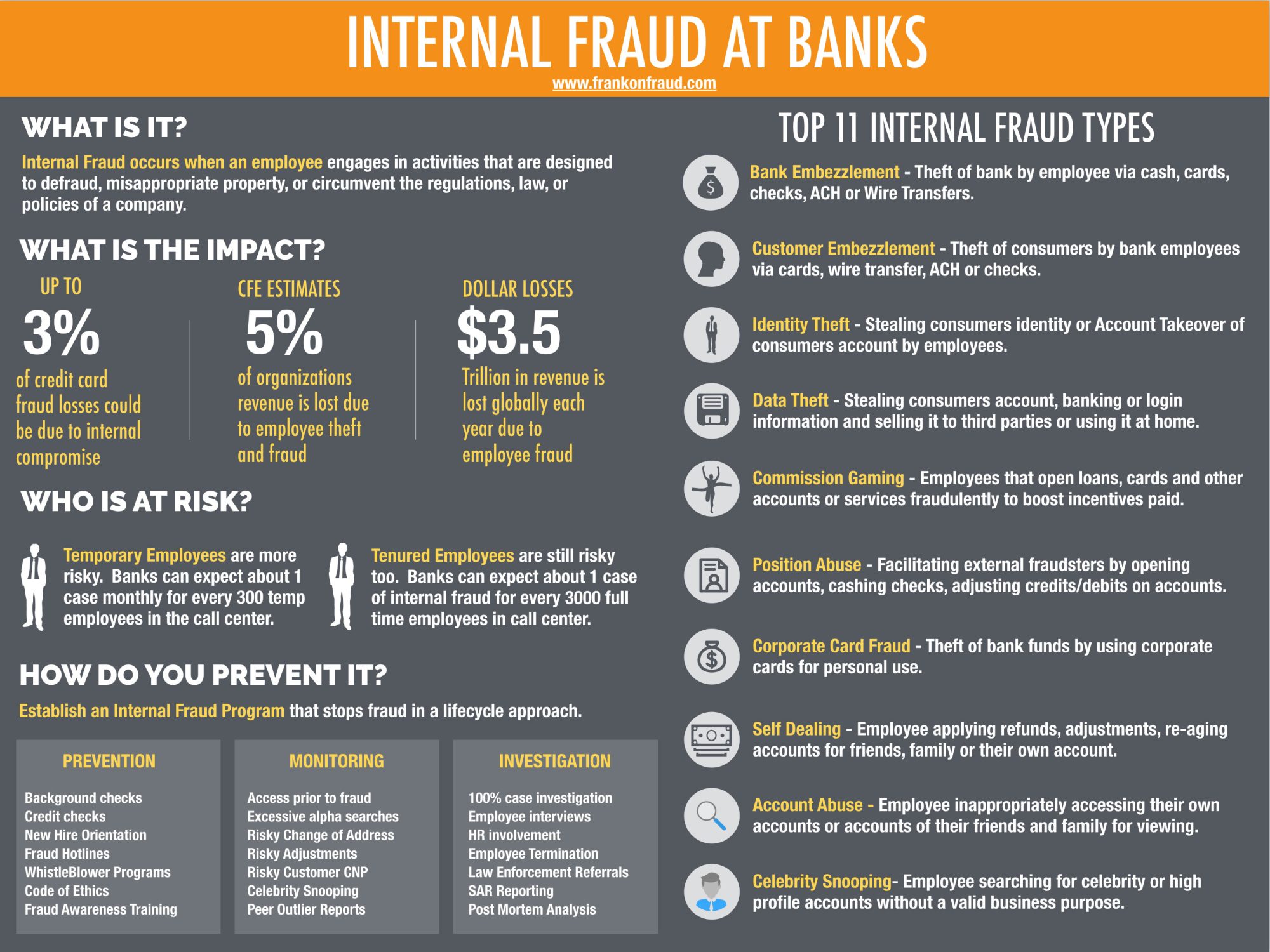

Common Types of Fraud to Watch Out For

Fraudulent activities can take many forms, and staying informed about the most common types can help you recognize potential threats. Below are some prevalent fraud schemes to be aware of:

Identity Theft

Identity theft occurs when someone uses your personal information without your permission. This can include accessing your bank accounts, opening new credit lines, or making unauthorized purchases.

Phishing Scams

Phishing involves fraudulent emails or messages that appear to be from legitimate sources, such as Fifth Third Bank. These messages often request sensitive information, such as account numbers or passwords.

Card Skimming

Card skimming devices are used to steal information from your debit or credit cards when you use them at ATMs or payment terminals. Always inspect machines for signs of tampering before using them.

Preventing Fraud: Tips and Best Practices

Preventing fraud requires a proactive approach. Here are some tips to help you protect your finances:

- Monitor your accounts regularly for suspicious activity.

- Use strong, unique passwords for all your online accounts.

- Enable two-factor authentication wherever possible.

- Be cautious when clicking links in emails or messages, even if they appear legitimate.

- Keep your software and antivirus programs up to date.

By implementing these practices, you significantly reduce the risk of becoming a victim of fraud.

Understanding Identity Theft

Identity theft is a serious issue that can have long-lasting effects on your financial well-being. It occurs when someone steals your personal information to commit fraud or other crimes. Understanding how identity theft happens and how to prevent it is crucial for protecting yourself.

Fifth Third Bank offers resources to help customers prevent and recover from identity theft. These include fraud alerts, credit monitoring services, and educational materials on safeguarding your personal information.

Signs of Identity Theft

- Unexplained charges on your bank statements.

- Receiving bills for accounts you didn't open.

- Denied credit despite a good credit history.

Steps to Take If You Suspect Fraud

If you suspect fraud on your Fifth Third Bank account, it's essential to act quickly. Follow these steps to minimize potential damage:

- Contact Fifth Third Bank immediately using the fraud phone number.

- Review your account statements for any unauthorized transactions.

- File a police report if necessary and keep a copy for your records.

- Monitor your credit reports for any suspicious activity.

Swift action can prevent further unauthorized access and help you recover any lost funds.

Fifth Third Bank Customer Support

Fifth Third Bank is committed to providing excellent customer support, especially in cases of fraud. Their dedicated fraud team works tirelessly to resolve issues and restore customers' trust. Whether you need to report fraud, request additional security measures, or seek guidance on protecting your accounts, Fifth Third Bank's customer support is here to assist you.

For non-fraud-related inquiries, Fifth Third Bank offers a variety of support channels, including phone, email, and live chat. These resources ensure that customers receive the assistance they need promptly and efficiently.

Conclusion

In conclusion, knowing the Fifth Third Bank fraud phone number and understanding the bank's fraud reporting process are essential for safeguarding your finances. By staying informed about common fraud schemes and implementing preventive measures, you can significantly reduce the risk of becoming a victim.

We encourage you to share this article with friends and family to help them protect their finances as well. If you have any questions or comments, please feel free to leave them below. Additionally, explore our other articles for more valuable insights on financial security and fraud prevention.

Remember, your vigilance is the first line of defense against fraud. Stay informed, stay alert, and trust Fifth Third Bank to assist you in protecting your financial future.

References:

- Fifth Third Bank Official Website

- Fifth Third Bank Security Center

- Fifth Third Bank Fraud Prevention Resources