Understanding the IRS help line is crucial for anyone seeking tax assistance. Whether you're dealing with a tax return issue, need clarification on deductions, or want to resolve an outstanding tax bill, the IRS helpline can provide the support you need. This guide will delve into everything you need to know about the IRS help line, ensuring you're well-prepared for any tax-related situation.

The Internal Revenue Service (IRS) is the U.S. government agency responsible for tax collection and enforcement. For millions of taxpayers, navigating the complexities of federal taxes can be overwhelming. That's where the IRS help line comes in—a direct line of communication to professionals who can answer your questions and guide you through the tax process.

In this comprehensive article, we'll explore the IRS help line's role, how to use it effectively, and how it fits into the broader framework of tax assistance. By the end of this guide, you'll have a clearer understanding of how the IRS help line can assist you in managing your tax obligations.

Read also:Who Is The Highest Paid Wnba Player Discover The Stars Of Womens Basketball

Table of Contents

- Introduction to the IRS Help Line

- A Brief History of IRS Taxpayer Services

- How to Contact the IRS Help Line

- Common Questions Answered by the IRS Help Line

- Sub: Questions About Tax Returns

- Sub: Questions About Payments and Penalties

- Other Forms of IRS Tax Assistance

- Sub: Virtual Assistance Programs

- Tips for Using the IRS Help Line Effectively

- IRS Help Line Usage Statistics

- The Future of IRS Taxpayer Support

- Conclusion and Call to Action

Introduction to the IRS Help Line

The IRS help line serves as a lifeline for taxpayers who need assistance with their tax obligations. Whether you're filing your first tax return or addressing a complex tax issue, this service provides direct access to IRS agents who can offer guidance and solutions.

The IRS help line is more than just a phone number—it's a resource designed to ensure taxpayers have the information they need to comply with federal tax laws. By calling the IRS help line, you can receive personalized support tailored to your specific situation.

Understanding how to use the IRS help line effectively can save you time and reduce stress during tax season. This section will provide an overview of the service, its purpose, and how it benefits taxpayers.

A Brief History of IRS Taxpayer Services

The IRS has evolved significantly since its inception in 1862. Initially established to collect taxes to fund the Civil War, the agency has grown into a comprehensive organization offering various taxpayer services, including the IRS help line.

Over the years, the IRS has expanded its reach through technology, providing online resources, mobile apps, and live chat support in addition to the traditional phone helpline. These advancements have made it easier for taxpayers to access the information they need.

Despite these changes, the IRS help line remains a vital component of taxpayer support. It offers a personal touch that digital tools sometimes lack, ensuring that taxpayers receive accurate and detailed assistance.

Read also:Ronnie Coleman Competition Weight Unveiling The Legendary Physique

How to Contact the IRS Help Line

Contacting the IRS help line is straightforward. The primary number for individual taxpayers is 1-800-829-1040. Business taxpayers can call 1-800-829-4933. These numbers are available Monday through Friday, from 7 a.m. to 7 p.m. local time.

Before calling, it's essential to gather all necessary documents, such as your Social Security number, tax return, and any correspondence from the IRS. This preparation ensures that the IRS agent can assist you more efficiently.

In addition to phone support, the IRS offers alternative methods of contact, including live chat on their website and email inquiries for less urgent matters. These options provide flexibility for taxpayers who prefer digital communication.

Common Questions Answered by the IRS Help Line

The IRS help line addresses a wide range of taxpayer inquiries. Below are some of the most common questions answered by IRS agents:

- How do I file an amended tax return?

- What are the deadlines for submitting tax documents?

- How can I check the status of my tax refund?

- What deductions am I eligible for?

- How do I resolve a tax debt?

These questions represent just a fraction of the topics covered by the IRS help line. Agents are trained to handle a variety of issues, ensuring taxpayers receive comprehensive support.

Sub: Questions About Tax Returns

Tax returns are a primary focus of IRS help line inquiries. Common concerns include missing forms, incorrect filings, and extensions. IRS agents can guide taxpayers through the process of correcting errors or obtaining necessary documents.

For example, if you realize you omitted income on your tax return, the IRS help line can explain how to file an amended return using Form 1040-X. Similarly, if you need more time to file, agents can assist with requesting an extension.

Sub: Questions About Payments and Penalties

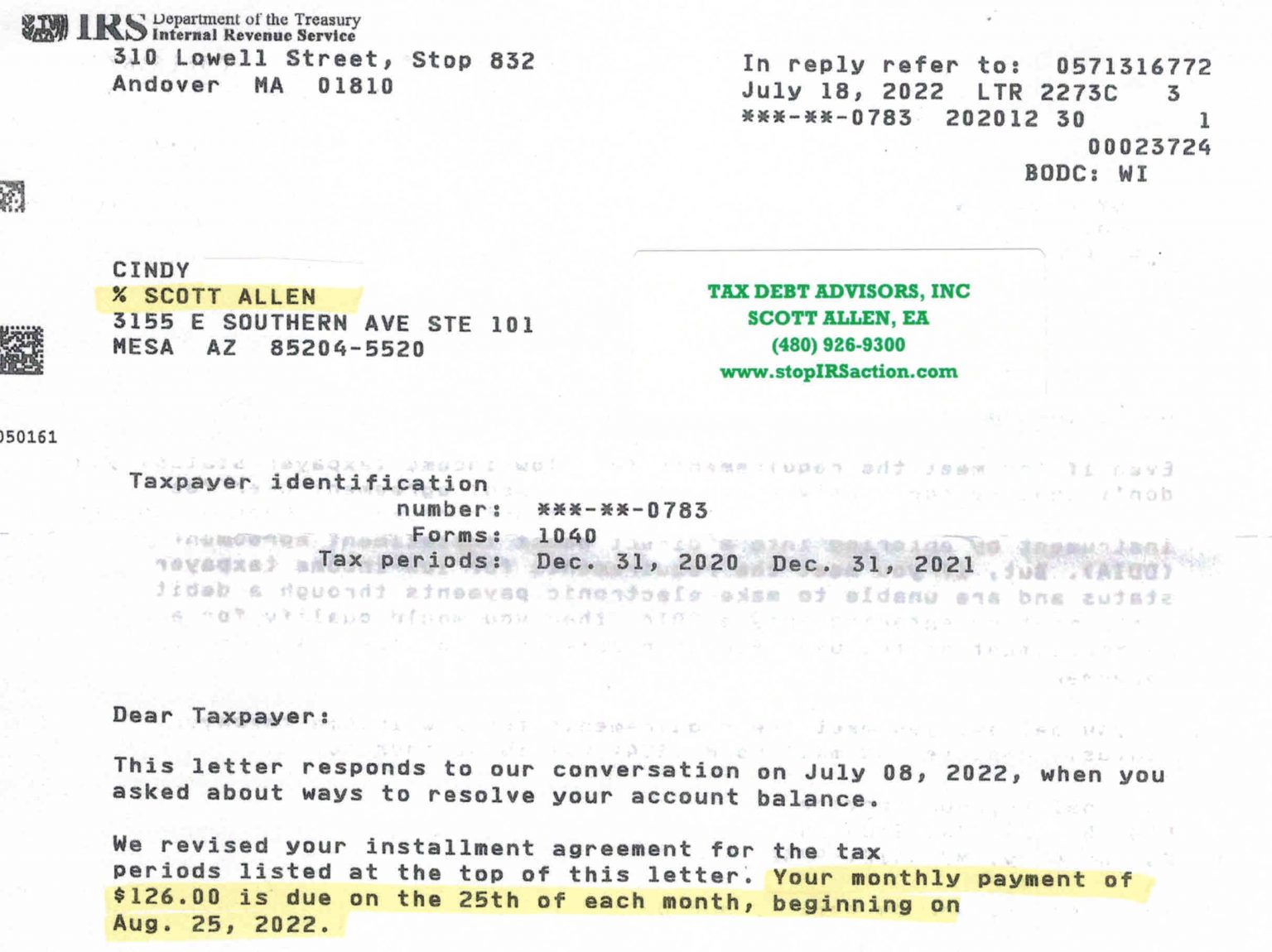

Another frequent topic is payments and penalties. Taxpayers often seek clarification on installment agreements, penalty relief, and payment plans. The IRS help line can provide information on these options and help you determine the best course of action.

For instance, if you're unable to pay your full tax liability, the IRS may offer an installment agreement or an offer in compromise. IRS agents can explain the requirements and assist with the application process.

Other Forms of IRS Tax Assistance

Beyond the IRS help line, the agency offers various resources to assist taxpayers. These include online tools, local offices, and partnerships with community organizations. Each resource complements the help line, providing additional avenues for support.

The IRS website is a treasure trove of information, featuring FAQs, forms, and publications. Additionally, the IRS offers a mobile app called IRS2Go, which allows users to check refund statuses and receive tax alerts.

Sub: Virtual Assistance Programs

Virtual assistance programs have become increasingly popular in recent years. The IRS offers a range of digital tools, such as the Interactive Tax Assistant (ITA), which helps taxpayers determine their eligibility for credits and deductions.

Another valuable resource is the IRS Video Portal, which provides tutorials and webinars on various tax topics. These resources empower taxpayers to take a proactive approach to managing their tax obligations.

Tips for Using the IRS Help Line Effectively

To maximize your experience with the IRS help line, consider the following tips:

- Prepare in advance: Gather all necessary documents and information before calling.

- Call during off-peak hours: Avoid busy periods, such as the days leading up to tax deadlines, to reduce wait times.

- Be patient: IRS agents handle a high volume of calls, so be prepared for potential delays.

- Take notes: Record the agent's name and the information provided for future reference.

- Follow up: If you need further clarification or assistance, don't hesitate to call back.

By following these tips, you can ensure a smoother and more productive interaction with the IRS help line.

IRS Help Line Usage Statistics

According to IRS data, the help line receives millions of calls each year. In 2022 alone, the IRS answered over 10 million taxpayer inquiries, with an average wait time of 17 minutes. These statistics highlight the demand for IRS assistance and the agency's commitment to serving taxpayers.

Despite challenges, such as staffing shortages and increased call volumes, the IRS continues to improve its services. Recent initiatives, including expanded hours and enhanced digital tools, aim to enhance taxpayer experiences.

Understanding these statistics can help taxpayers set realistic expectations when contacting the IRS help line. While wait times may vary, the service remains a valuable resource for resolving tax-related issues.

The Future of IRS Taxpayer Support

As technology continues to evolve, the IRS is exploring new ways to enhance taxpayer support. Artificial intelligence, machine learning, and advanced data analytics are among the innovations being considered to improve efficiency and accuracy.

Additionally, the IRS plans to expand its virtual assistance programs, offering more interactive tools and resources to assist taxpayers. These developments aim to create a more streamlined and user-friendly experience for all taxpayers.

While the IRS help line will remain a cornerstone of taxpayer support, these advancements promise to complement the service, providing taxpayers with even more options for assistance.

Conclusion and Call to Action

In conclusion, the IRS help line is an invaluable resource for taxpayers seeking assistance with their tax obligations. By understanding how to use the service effectively and exploring additional IRS resources, you can navigate the complexities of federal taxes with confidence.

We encourage you to share this article with others who may benefit from the information. Additionally, consider exploring the IRS website and other digital tools to enhance your tax knowledge. If you have further questions or feedback, please leave a comment below or visit our other articles for more insights.

Remember, the IRS help line is just one of many resources available to support you in managing your tax responsibilities. Stay informed, stay proactive, and take advantage of the tools at your disposal to ensure a stress-free tax season.