Business owners face countless risks every day, from customer injuries to property damage, which is why having the right insurance coverage is crucial. The Hartford general liability quote provides a tailored solution to safeguard your business against potential claims and lawsuits. With a reputation for reliability and comprehensive coverage, The Hartford has become a trusted name in the insurance industry. In this guide, we will explore everything you need to know about The Hartford general liability quote, ensuring you make informed decisions for your business.

General liability insurance is a fundamental component of any business's risk management strategy. It protects your company from third-party claims related to bodily injury, property damage, advertising injury, and more. The Hartford offers customizable policies designed to meet the unique needs of small and medium-sized businesses. By obtaining a quote, you can gain insight into the coverage options and pricing that align with your business requirements.

This article will delve into the specifics of The Hartford general liability quote, including its benefits, coverage options, and the process of obtaining a quote. Whether you're a new business owner or an experienced entrepreneur, understanding your insurance needs is essential for long-term success. Let's explore how The Hartford can help you secure your business's future.

Read also:Madden Nfl 24 Xbox One The Ultimate Guide To Mastering The Game

Understanding The Hartford General Liability Insurance

What Is General Liability Insurance?

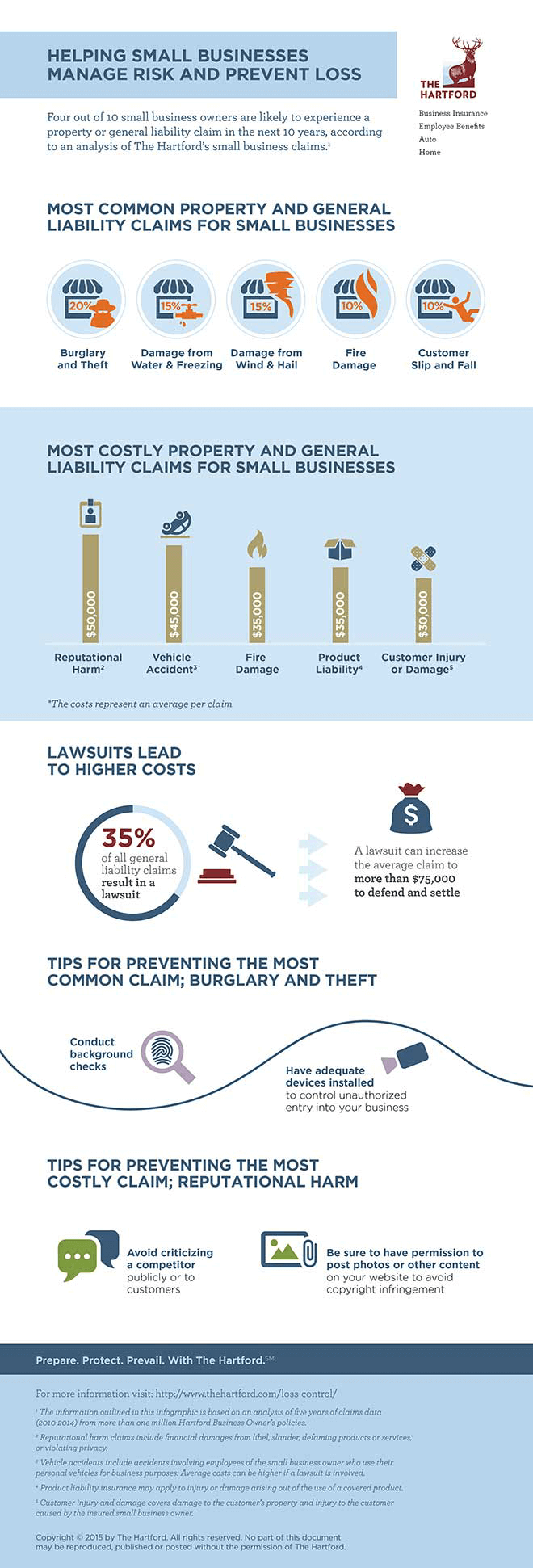

General liability insurance is a type of commercial insurance that protects businesses from financial losses arising from third-party claims. These claims typically include bodily injury, property damage, and advertising injury. For instance, if a customer slips and falls in your store, or if your business is accused of defamation, general liability insurance can cover the associated legal fees and settlements.

Businesses across various industries, such as retail, construction, and professional services, rely on general liability insurance to mitigate risks. According to a study by the National Federation of Independent Business (NFIB), approximately 70% of small businesses face at least one liability claim during their lifetime. This highlights the importance of having adequate coverage to protect your assets and reputation.

Why Choose The Hartford?

The Hartford stands out as one of the leading providers of general liability insurance. With over 200 years of experience, the company has earned a reputation for delivering reliable and comprehensive coverage. Here are some reasons why businesses trust The Hartford:

- Customizable policies tailored to specific business needs

- Competitive pricing with no hidden fees

- 24/7 customer support and claim assistance

- A robust network of agents and brokers

By partnering with The Hartford, businesses can benefit from their expertise and resources, ensuring they are well-prepared for any unexpected events.

Key Benefits of The Hartford General Liability Quote

Comprehensive Coverage Options

When you request a The Hartford general liability quote, you gain access to a wide range of coverage options. These options include:

- Bodily injury liability

- Property damage liability

- Medical payments coverage

- Advertising injury liability

Each coverage type addresses specific risks that businesses may encounter. For example, medical payments coverage can help cover the costs of minor injuries that occur on your premises, even if you are not at fault. This can prevent small incidents from escalating into costly lawsuits.

Read also:Julian Edelmans Weight And Height A Comprehensive Look At The Nfl Star

Competitive Pricing

The Hartford understands that businesses operate on tight budgets. Therefore, they offer competitive pricing for their general liability policies. Factors that influence the cost of your quote include:

- Your industry and business type

- The size and location of your business

- Your claims history and risk profile

By analyzing these factors, The Hartford can provide a personalized quote that aligns with your financial constraints while ensuring adequate coverage.

How to Obtain a The Hartford General Liability Quote

Step-by-Step Process

Obtaining a The Hartford general liability quote is a straightforward process. Follow these steps to get started:

- Visit The Hartford's official website or contact a licensed agent.

- Provide essential business information, such as your industry, annual revenue, and number of employees.

- Select the coverage options that best suit your needs.

- Review the quote and make any necessary adjustments.

- Submit your application and proceed with the underwriting process.

This process ensures that you receive a quote tailored to your business's unique requirements. Additionally, The Hartford's knowledgeable agents can guide you through each step, answering any questions you may have along the way.

Factors Affecting Your The Hartford General Liability Quote

Industry and Business Type

Your industry and business type play a significant role in determining the cost of your The Hartford general liability quote. High-risk industries, such as construction and manufacturing, may incur higher premiums due to the increased likelihood of claims. Conversely, low-risk industries, like consulting and retail, may enjoy more affordable rates.

Claims History

Your business's claims history is another critical factor that affects your quote. Businesses with a history of frequent claims may face higher premiums, as they are considered higher-risk. On the other hand, businesses with a clean claims record may qualify for discounts and lower rates.

Additional Coverage Options with The Hartford

Professional Liability Insurance

In addition to general liability insurance, The Hartford offers professional liability insurance (also known as errors and omissions insurance) for businesses that provide services. This coverage protects against claims of negligence, mistakes, or inadequate work. Industries such as healthcare, law, and finance often require professional liability insurance to safeguard their reputation and assets.

Workers' Compensation Insurance

Workers' compensation insurance is another essential coverage option available through The Hartford. It provides financial protection for employees who suffer work-related injuries or illnesses. By bundling workers' compensation insurance with general liability insurance, businesses can enjoy additional savings and peace of mind.

Real-Life Examples of The Hartford General Liability Claims

Case Study: Slip and Fall Accident

A retail store owner in New York purchased a The Hartford general liability policy to protect their business from potential claims. One day, a customer slipped on a wet floor and sustained a minor injury. The customer filed a claim for medical expenses and lost wages. Thanks to their The Hartford policy, the store owner was able to cover the costs without incurring any out-of-pocket expenses.

Case Study: Advertising Injury

A marketing agency faced a lawsuit alleging defamation in one of their client's advertisements. The agency's The Hartford general liability policy included advertising injury coverage, which covered the legal fees and settlement costs associated with the lawsuit. This allowed the agency to focus on their core business operations without worrying about financial repercussions.

Tips for Maximizing Your The Hartford General Liability Coverage

Regularly Review Your Policy

To ensure your business is adequately covered, it's essential to regularly review your The Hartford general liability policy. As your business grows and evolves, your insurance needs may change. By staying proactive, you can avoid gaps in coverage and ensure you have the right protection in place.

Implement Risk Management Strategies

In addition to insurance, implementing risk management strategies can help reduce the likelihood of claims. This may include employee training programs, safety protocols, and regular maintenance of your premises. By minimizing risks, you can lower your premiums and improve your business's overall resilience.

Conclusion

In conclusion, obtaining a The Hartford general liability quote is a crucial step in protecting your business from potential risks and liabilities. By understanding the coverage options, pricing factors, and additional benefits offered by The Hartford, you can make informed decisions that align with your business's needs. Remember to regularly review your policy and implement risk management strategies to maximize your coverage and minimize risks.

We encourage you to take action by requesting a quote today. Whether you're a new business owner or an experienced entrepreneur, The Hartford's comprehensive insurance solutions can help you secure your business's future. Don't forget to share this article with fellow business owners and leave a comment below with any questions or feedback. Together, let's build a safer and more resilient business community.

Table of Contents

- Understanding The Hartford General Liability Insurance

- Key Benefits of The Hartford General Liability Quote

- How to Obtain a The Hartford General Liability Quote

- Factors Affecting Your The Hartford General Liability Quote

- Additional Coverage Options with The Hartford

- Real-Life Examples of The Hartford General Liability Claims

- Tips for Maximizing Your The Hartford General Liability Coverage

- Conclusion