Have you ever wondered what an ABA number is and why it's crucial in banking transactions? The ABA number, also known as the routing transit number (RTN), plays a pivotal role in facilitating seamless financial operations. This unique nine-digit code ensures that funds are routed correctly between financial institutions.

As digital banking continues to evolve, understanding the intricacies of the ABA number has become increasingly important for both individuals and businesses. Whether you're setting up direct deposits, conducting wire transfers, or paying bills online, the ABA number is indispensable.

In this article, we will delve into the world of ABA numbers, exploring their purpose, structure, and significance. By the end, you'll have a clear understanding of how this system works and why it's essential for modern banking.

Read also:Santa Clarita Population 2023 An Indepth Analysis And Insights

Table of Contents

- Introduction to ABA Numbers

- The History of ABA Numbers

- Structure of an ABA Number

- Common Uses of ABA Numbers

- How to Find Your ABA Number

- ABA Number vs. SWIFT Code

- Security Considerations for ABA Numbers

- Changes in the ABA Number System

- Global Implications of ABA Numbers

- The Future of ABA Numbers

Introduction to ABA Numbers

The American Bankers Association (ABA) introduced the routing transit number system in 1910 to streamline banking operations. An ABA number serves as a unique identifier for financial institutions, ensuring that transactions are directed to the correct bank or credit union.

This number is essential for various banking activities, such as direct deposits, automatic payments, and electronic funds transfers. It acts as a bridge between financial institutions, enabling them to communicate and exchange funds efficiently.

Why is the ABA Number Important?

The ABA number is crucial for maintaining the integrity of financial transactions. Without it, banks would struggle to process payments accurately and efficiently. Its role in modern banking cannot be overstated, as it underpins the infrastructure of electronic fund transfers.

The History of ABA Numbers

When the ABA first introduced the routing transit number system in 1910, its primary purpose was to simplify check processing. Over the years, the system has evolved to accommodate advancements in technology and the growing complexity of financial transactions.

Evolution of the ABA Number System

- 1910: Initial introduction of the routing transit number system.

- 1950s: Adoption of magnetic ink character recognition (MICR) technology.

- 1990s: Expansion to include electronic funds transfers.

- 2000s: Integration with online banking platforms.

Structure of an ABA Number

An ABA number consists of nine digits, each with a specific purpose. The first four digits represent the Federal Reserve routing symbol, while the next four digits identify the financial institution. The final digit serves as a checksum to ensure the accuracy of the number.

Format of an ABA Number

- Digits 1-4: Federal Reserve routing symbol.

- Digits 5-8: Financial institution identifier.

- Digit 9: Checksum digit.

Common Uses of ABA Numbers

ABA numbers are used in a variety of banking transactions, including:

Read also:Understanding The Security And Functionality Of Https Aka Ms Remoteconnect Com

- Direct deposits.

- Automatic payments.

- Wire transfers.

- Bill payments.

Each of these applications relies on the ABA number to ensure that funds are routed correctly and securely.

How to Find Your ABA Number

Locating your ABA number is a straightforward process. It can typically be found at the bottom of your checks, on your bank statement, or through your bank's online portal. If you're unsure where to look, contacting your bank's customer service department can provide additional guidance.

Finding Your ABA Number Online

Many banks offer online tools that allow customers to access their ABA number directly from their account dashboard. This convenient feature eliminates the need to physically search for the number on checks or statements.

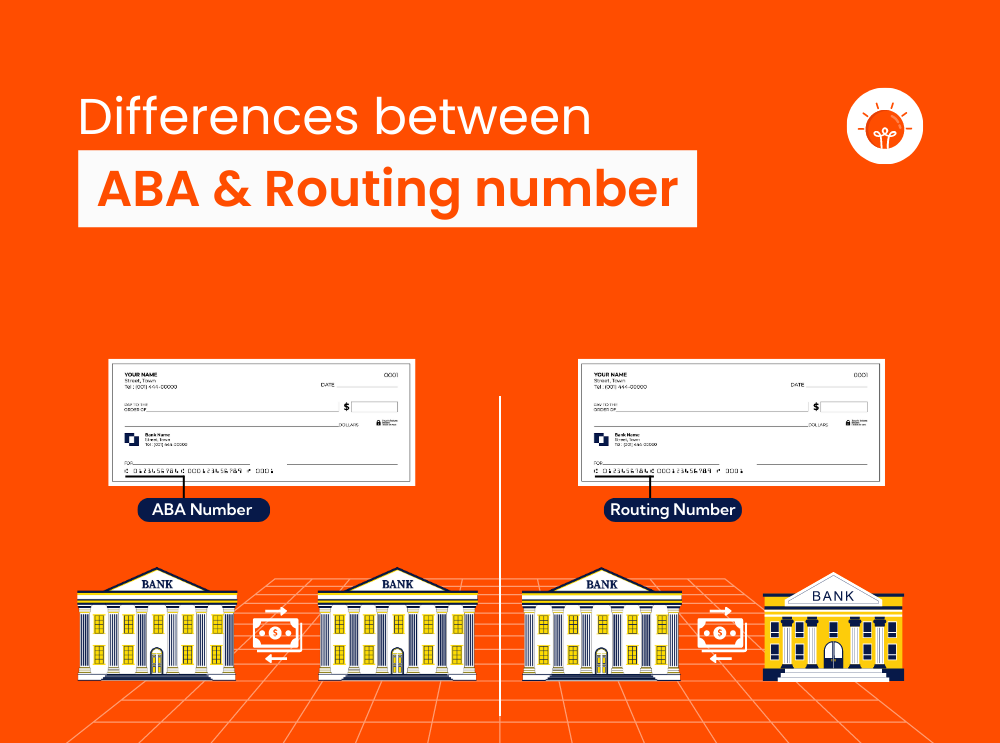

ABA Number vs. SWIFT Code

While both ABA numbers and SWIFT codes facilitate financial transactions, they serve different purposes. ABA numbers are primarily used for domestic transactions within the United States, whereas SWIFT codes are utilized for international transfers.

Comparison of ABA Numbers and SWIFT Codes

- ABA Number: Domestic transactions in the U.S.

- SWIFT Code: International transactions.

Security Considerations for ABA Numbers

Protecting your ABA number is crucial to safeguarding your financial information. Sharing this number with unauthorized parties can lead to fraudulent activities and financial losses. Always verify the legitimacy of any request for your ABA number before providing it.

Tips for Securing Your ABA Number

- Never share your ABA number publicly.

- Verify the authenticity of requests for your ABA number.

- Use secure channels when transmitting your ABA number electronically.

Changes in the ABA Number System

The ABA number system continues to evolve to meet the demands of modern banking. Recent changes include the adoption of new technologies and the implementation of enhanced security measures to protect against fraud.

Impact of Technology on the ABA Number System

Advancements in technology have significantly improved the efficiency and security of the ABA number system. From digital check imaging to real-time transaction processing, these innovations have transformed the way banks operate.

Global Implications of ABA Numbers

Although ABA numbers are primarily used in the United States, their influence extends beyond national borders. As global banking continues to expand, understanding the ABA number system is becoming increasingly important for international financial institutions.

International Use of ABA Numbers

While ABA numbers are not universally adopted, their principles and structure have influenced similar systems in other countries. This global perspective highlights the importance of standardization in banking practices.

The Future of ABA Numbers

As technology continues to advance, the role of ABA numbers in banking is likely to evolve. Innovations such as blockchain and artificial intelligence may reshape the way financial institutions process transactions, but the core principles of the ABA number system will remain relevant.

Innovations in the ABA Number System

Looking ahead, the integration of emerging technologies into the ABA number system promises to enhance security, efficiency, and accessibility. These developments will ensure that the system remains a cornerstone of modern banking.

Conclusion

In summary, the ABA number is a vital component of the banking system, enabling seamless and secure financial transactions. By understanding its structure, uses, and security considerations, you can better navigate the complexities of modern banking.

We invite you to share your thoughts and experiences with ABA numbers in the comments below. Additionally, feel free to explore other articles on our site for more insights into the world of finance and banking.