Understanding the intricacies of the US Department of Treasury Bureau of Fiscal Service check is crucial for anyone dealing with federal payments, refunds, or financial transactions involving the US government. Whether you are a taxpayer, business owner, or government contractor, this guide will provide you with a detailed breakdown of everything you need to know about these checks and their processes.

The Bureau of Fiscal Service plays a pivotal role in managing the financial operations of the United States government. As part of its responsibilities, it handles the issuance and processing of checks for various purposes, including tax refunds, social security payments, and federal reimbursements. This article aims to demystify the workings of the Bureau of Fiscal Service and its check-related services.

By the end of this article, you will have a comprehensive understanding of the Bureau of Fiscal Service check, its importance, and how it affects individuals and businesses. Additionally, you will learn about the steps to verify, track, and manage these checks effectively.

Read also:Home Depot Port Charlotte Your Ultimate Guide To Home Improvement

Table of Contents

- Overview of the Bureau of Fiscal Service

- Types of Checks Issued by the Bureau of Fiscal Service

- The Process of Issuing Checks

- How to Track Your Bureau of Fiscal Service Check

- Security Features of Bureau of Fiscal Service Checks

- Common Issues with Checks and Solutions

- Transition to Digital Payments

- Frequently Asked Questions

- Useful Resources and References

- Conclusion and Call to Action

Overview of the Bureau of Fiscal Service

The Bureau of Fiscal Service, a division of the US Department of Treasury, is responsible for managing the financial operations of the federal government. Established to streamline fiscal activities, the Bureau ensures that all government payments are processed efficiently and securely.

Key Responsibilities of the Bureau

Among its many duties, the Bureau of Fiscal Service focuses on issuing checks for various purposes, including:

- Tax refunds

- Government grants

- Social security payments

- Federal employee salaries

These checks are issued through a meticulous process designed to ensure accuracy and security.

Types of Checks Issued by the Bureau of Fiscal Service

The Bureau of Fiscal Service issues several types of checks, each serving a specific purpose. Below are some of the most common checks:

Tax Refund Checks

Tax refund checks are issued to taxpayers who have overpaid their taxes. These checks are processed after the IRS reviews the tax return and determines the amount of refund due.

Social Security Checks

These checks are issued to beneficiaries of Social Security programs, including retirement benefits, disability benefits, and survivor benefits.

Read also:Vinicius Jr Stats This Season An Indepth Analysis Of His Performance

The Process of Issuing Checks

The process of issuing a US Department of Treasury Bureau of Fiscal Service check involves several stages:

- Verification of eligibility

- Approval by relevant government agencies

- Printing and mailing the check

Each stage is carefully monitored to ensure accuracy and prevent fraud.

How to Track Your Bureau of Fiscal Service Check

Tracking your Bureau of Fiscal Service check is essential to ensure that it has been processed and sent correctly. Below are some methods to track your check:

Using the IRS Website

Taxpayers can use the IRS "Where's My Refund?" tool to track their tax refund checks. This tool provides real-time updates on the status of the check.

Contacting the Bureau of Fiscal Service

If you encounter issues with your check, you can contact the Bureau of Fiscal Service directly for assistance. They provide customer support to help resolve any concerns.

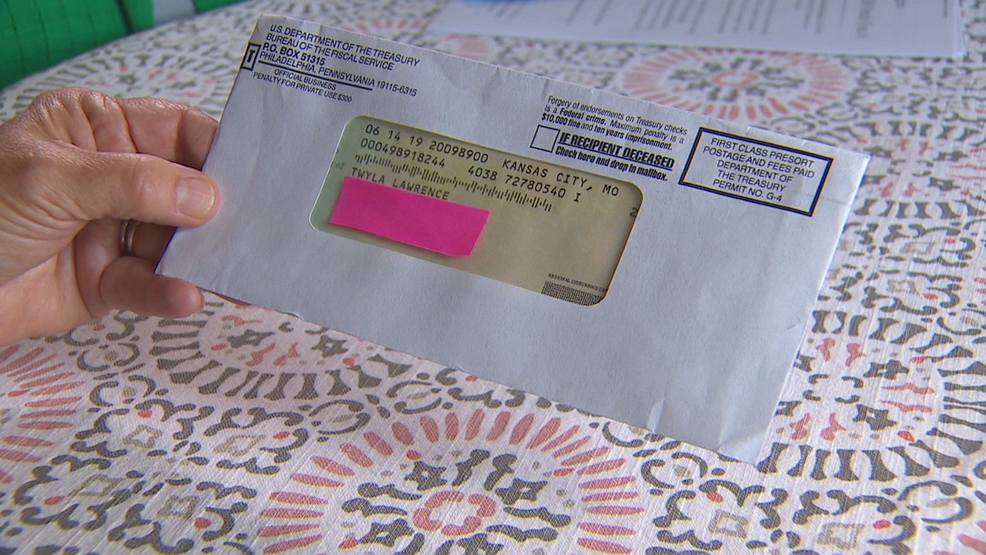

Security Features of Bureau of Fiscal Service Checks

Bureau of Fiscal Service checks come with several security features to prevent fraud and counterfeiting:

- Watermark

- Security threads

- Microprinting

- UV ink

These features ensure that the checks are genuine and protect both the government and the recipients from fraudulent activities.

Common Issues with Checks and Solutions

Despite the robust processes, issues with Bureau of Fiscal Service checks can arise. Below are some common problems and their solutions:

Lost or Stolen Checks

If your check is lost or stolen, contact the Bureau of Fiscal Service immediately to report the issue. They will guide you through the process of obtaining a replacement check.

Incorrect Amounts

In cases where the check amount is incorrect, contact the issuing agency to resolve the discrepancy. Providing supporting documentation can expedite the resolution process.

Transition to Digital Payments

In recent years, the Bureau of Fiscal Service has been transitioning toward digital payments to enhance efficiency and reduce costs. Direct deposit is now the preferred method for receiving government payments.

Advantages of Digital Payments

Switching to digital payments offers several benefits:

- Speedier processing times

- Enhanced security

- Reduced risk of lost or stolen checks

Individuals and businesses are encouraged to enroll in direct deposit for their government payments.

Frequently Asked Questions

Below are some frequently asked questions about the US Department of Treasury Bureau of Fiscal Service check:

How Long Does It Take to Receive a Check?

The processing time for Bureau of Fiscal Service checks varies depending on the type of payment. Tax refunds typically take 2-3 weeks, while other payments may take longer.

Can I Cash My Check at Any Bank?

Most banks will cash Bureau of Fiscal Service checks, but it is advisable to verify with your bank beforehand. Some banks may require identification or impose limits on the amount they can cash.

Useful Resources and References

For further information on Bureau of Fiscal Service checks, refer to the following resources:

These resources provide comprehensive information on government payments and fiscal operations.

Conclusion and Call to Action

In conclusion, understanding the US Department of Treasury Bureau of Fiscal Service check is vital for anyone involved in federal financial transactions. By familiarizing yourself with the processes, security features, and troubleshooting methods, you can ensure smooth and secure receipt of your payments.

We encourage you to share this article with others who may benefit from it. Feel free to leave a comment or question below, and don't hesitate to explore other informative articles on our website. Together, we can enhance financial literacy and empower individuals and businesses alike.