ABA routing numbers are crucial elements in the financial ecosystem, serving as a vital link between banks for seamless transactions. Whether you're issuing checks or setting up direct deposits, understanding the ABA number on check is essential for ensuring smooth financial operations. This article will explore everything you need to know about ABA numbers, their purpose, and how they work.

In today's digital age, financial transactions have become more complex, yet more efficient. ABA routing numbers play a pivotal role in this process, ensuring that money moves accurately between banks. By understanding how these numbers function, you can avoid errors and ensure your financial dealings are processed correctly.

This guide will delve into the intricacies of ABA numbers, providing you with detailed information to help you navigate the financial landscape. Whether you're a business owner, a student, or an individual managing personal finances, this information is invaluable for anyone dealing with checks or bank transfers.

Read also:Madden Nfl 24 Xbox One The Ultimate Guide To Mastering The Game

What is an ABA Number on Check?

An ABA number, also known as the routing transit number (RTN), is a nine-digit code that identifies the financial institution responsible for a given financial transaction. This number is crucial for processing checks, wire transfers, and automated clearing house (ACH) transactions. It ensures that funds are directed to the correct bank or credit union.

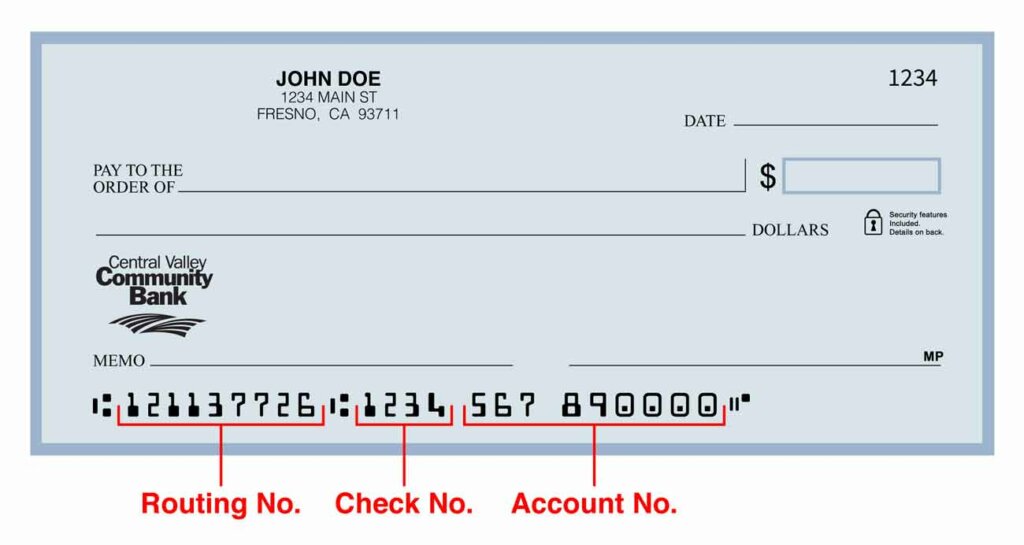

On a check, the ABA number is typically located at the bottom left corner. It appears in a magnetic ink character recognition (MICR) format, allowing banks to process checks quickly and accurately. Understanding where to find this number is essential for anyone involved in check-based transactions.

Where to Find the ABA Number on Check

Finding the ABA number on a check is straightforward. Look at the bottom of the check where you'll see a series of numbers printed in a special font. The first set of nine numbers is the ABA routing number. To ensure accuracy, double-check that the number is nine digits long and matches the information provided by your bank.

- Bottom left corner of the check

- Nine-digit code

- Part of the MICR line

History and Importance of ABA Numbers

The American Bankers Association (ABA) introduced routing numbers in 1910 to streamline check processing. Over the decades, these numbers have evolved to accommodate modern banking needs, including electronic transactions. Today, ABA numbers are indispensable for maintaining the integrity and efficiency of the financial system.

Each ABA number is unique to a specific financial institution and geographic location. This specificity ensures that transactions are routed correctly, minimizing errors and delays. For businesses and individuals alike, understanding the importance of ABA numbers is crucial for maintaining financial health.

How ABA Numbers Work

When you issue a check or initiate a transfer, the ABA number is used to direct the transaction to the correct bank. Banks use this number to verify account information and process payments. Without an accurate ABA number, transactions may be delayed or rejected, leading to potential financial complications.

Read also:Who Is The Highest Paid Wnba Player Discover The Stars Of Womens Basketball

- Identifies the bank or credit union

- Directs transactions to the correct institution

- Ensures accurate processing of payments

Types of ABA Numbers

There are two main types of ABA numbers: ACH routing numbers and wire routing numbers. While both serve the purpose of directing transactions, they differ in their specific applications. ACH numbers are used for electronic transactions, such as direct deposits and bill payments, while wire routing numbers are used for wire transfers.

Understanding the distinction between these two types is essential for ensuring that transactions are processed correctly. Banks often provide both types of numbers, and it's important to use the appropriate one based on the transaction type.

ACH Routing Numbers

ACH routing numbers are specifically designed for electronic transactions. They are used for direct deposits, automatic bill payments, and other recurring transactions. These numbers ensure that funds are transferred securely and efficiently between accounts.

- Used for electronic transactions

- Facilitates direct deposits and bill payments

- Enhances transaction security

How to Verify an ABA Number

Verifying an ABA number is crucial to avoid transaction errors. You can verify the number by checking your bank's official website or contacting customer service. Additionally, many financial institutions provide online tools to help customers confirm the accuracy of their ABA numbers.

When verifying an ABA number, ensure that it matches the information on your checks and bank statements. Discrepancies may indicate errors or potential fraud, so it's important to address any issues promptly.

Steps to Verify an ABA Number

Follow these steps to verify your ABA number:

- Check the bottom of your check for the nine-digit code

- Compare it with the information on your bank statement

- Contact your bank's customer service for confirmation

Common Mistakes with ABA Numbers

Errors involving ABA numbers can lead to significant financial issues. Common mistakes include entering the wrong number, using an outdated number, or confusing ACH and wire routing numbers. To avoid these pitfalls, always double-check the number before initiating a transaction.

Additionally, be cautious of scams involving fake ABA numbers. Legitimate financial institutions will never ask for your ABA number via email or text. If you receive such a request, report it to your bank immediately.

How to Avoid ABA Number Errors

Here are some tips to avoid common mistakes with ABA numbers:

- Double-check the number before initiating transactions

- Use the correct type of routing number for the transaction

- Stay vigilant against scams and phishing attempts

ABA Numbers and Online Banking

With the rise of online banking, ABA numbers have become even more important. Many online platforms require users to input their ABA numbers when setting up direct deposits or transferring funds. Understanding how to use these numbers in a digital context is essential for managing finances effectively.

Most online banking systems provide easy access to ABA numbers, often displayed prominently in the account settings section. This convenience allows users to manage their finances with greater ease and accuracy.

Using ABA Numbers in Online Transactions

When using ABA numbers for online transactions, follow these best practices:

- Ensure the platform is secure and legitimate

- Double-check the number before submission

- Monitor transactions for accuracy and completeness

ABA Numbers and International Transactions

While ABA numbers are primarily used for domestic transactions, they can also play a role in international banking. For cross-border transactions, additional information such as SWIFT codes may be required. Understanding how ABA numbers interact with other banking codes is essential for global financial dealings.

For businesses operating internationally, having a clear understanding of ABA numbers and their applications is crucial for maintaining smooth financial operations. Consulting with a financial advisor can help ensure compliance with international banking regulations.

ABA Numbers in Global Banking

Here are some key considerations for using ABA numbers in international transactions:

- Understand the role of ABA numbers in global banking

- Be aware of additional requirements such as SWIFT codes

- Consult with experts for complex financial dealings

Troubleshooting ABA Number Issues

Encountering issues with ABA numbers can be frustrating, but there are steps you can take to resolve them. Common problems include incorrect numbers, outdated information, or system errors. By addressing these issues promptly, you can minimize disruptions to your financial activities.

If you suspect an issue with your ABA number, contact your bank immediately for assistance. Banks are equipped to help customers resolve ABA-related problems quickly and efficiently.

Solutions for ABA Number Problems

Here are some solutions for common ABA number issues:

- Contact your bank for verification and assistance

- Update outdated information in your banking records

- Monitor transactions for any signs of errors or fraud

Conclusion

In conclusion, understanding the ABA number on check is essential for anyone involved in financial transactions. From identifying the correct bank to ensuring accurate processing, ABA numbers play a critical role in maintaining the integrity of the financial system. By following the guidelines outlined in this article, you can avoid common mistakes and ensure smooth financial operations.

We invite you to share your thoughts and experiences with ABA numbers in the comments section below. Additionally, feel free to explore other articles on our site for more valuable insights into personal and business finance. Together, let's build a stronger financial future!

Table of Contents

- What is an ABA Number on Check?

- History and Importance of ABA Numbers

- Types of ABA Numbers

- How to Verify an ABA Number

- Common Mistakes with ABA Numbers

- ABA Numbers and Online Banking

- ABA Numbers and International Transactions

- Troubleshooting ABA Number Issues

- Conclusion

Sources:

- American Bankers Association (ABA)

- Federal Reserve Board

- Consumer Financial Protection Bureau (CFPB)