The US Dollar Debt Clock has become a critical indicator for understanding the financial health of the United States. It serves as a real-time tracker of the nation's growing debt, offering insights into the fiscal policies that shape the economy. As the world's largest economy, the US debt situation is of global significance, impacting not only its citizens but also international markets.

The concept of tracking national debt is not new, but with the advent of technology, the US Dollar Debt Clock has made it easier for people to stay informed. It provides a visual representation of the increasing debt levels, allowing policymakers, economists, and the general public to monitor the situation closely. This tool is essential for anyone interested in the long-term sustainability of the US economy.

As the debt continues to rise, understanding its implications becomes more important. This article will explore the intricacies of the US Dollar Debt Clock, its significance, and the potential consequences of a growing national debt. Whether you're a finance professional, a student, or simply someone curious about the state of the economy, this article aims to provide comprehensive insights.

Read also:Who Is Colt Gray Unveiling The Remarkable Life And Career Of A Rising Star

What is the US Dollar Debt Clock?

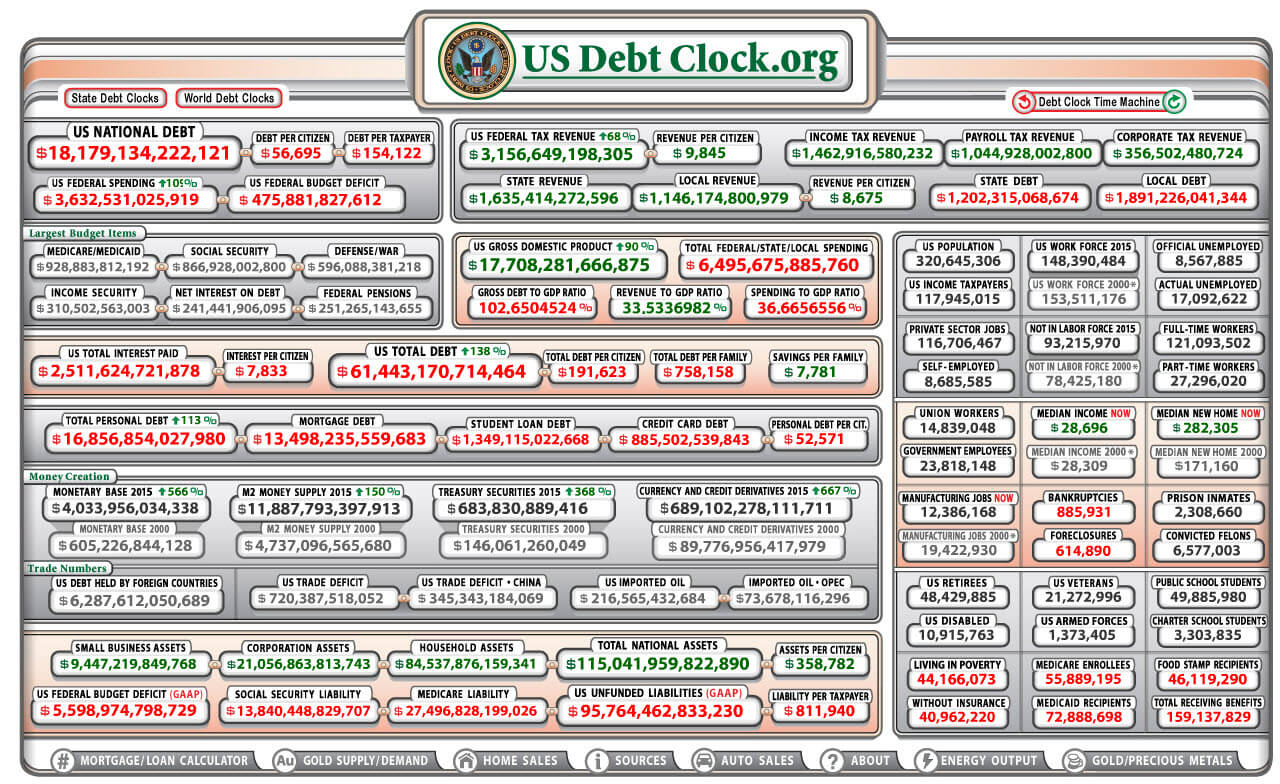

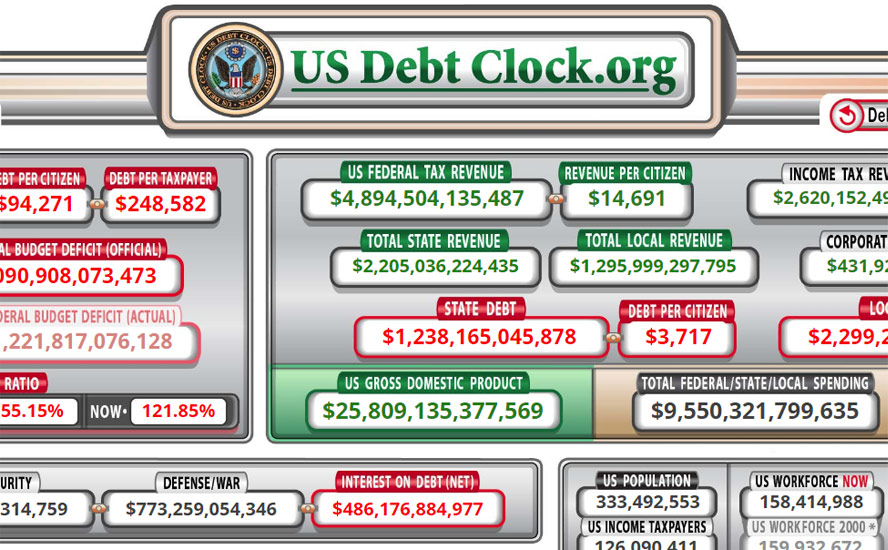

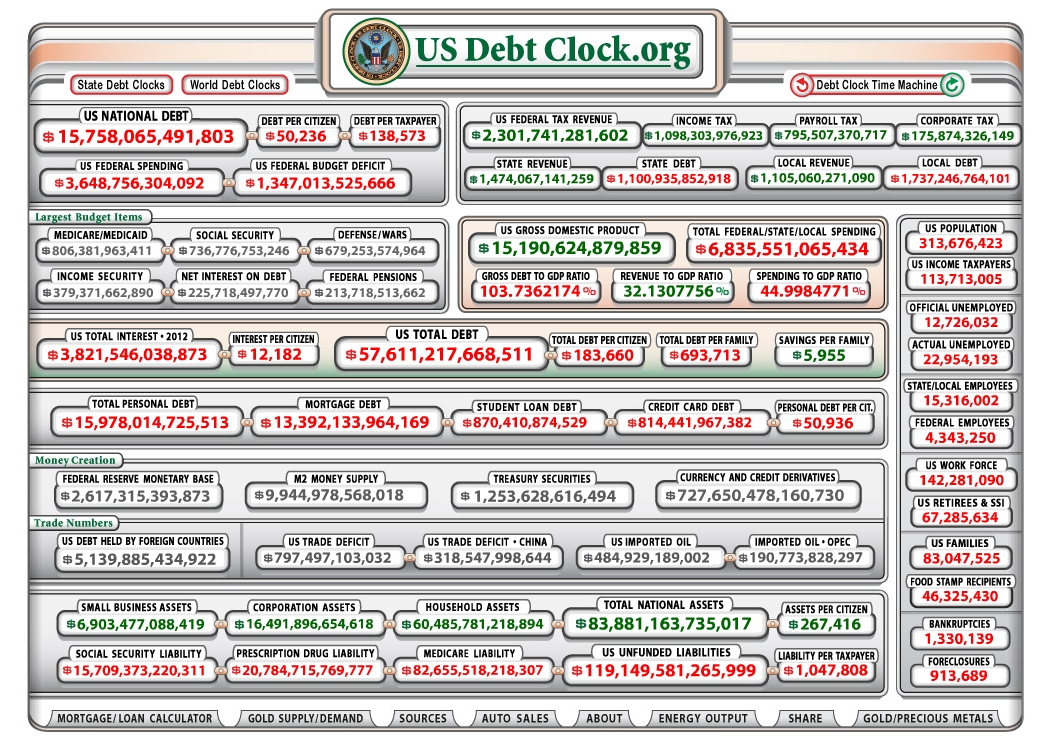

The US Dollar Debt Clock is a digital tool that displays the real-time national debt of the United States. It tracks not only the federal debt but also other financial metrics such as population, GDP, and per capita debt. This clock serves as a transparent and accessible way for the public to understand the financial obligations of the government.

First introduced in 1989 by Seymour Durst, a New York real estate developer, the original debt clock was a physical display in Times Square. Over the years, it has evolved into an online platform, making it more accessible to a global audience. The clock updates continuously, providing a snapshot of the nation's financial health at any given moment.

Why is the US Dollar Debt Clock Important?

The US Dollar Debt Clock is crucial because it highlights the financial challenges facing the nation. By showcasing the growing debt, it prompts discussions about fiscal responsibility and the sustainability of government spending. Here are some reasons why the debt clock matters:

- Transparency: It provides clear and real-time information about the nation's debt.

- Public Awareness: It educates citizens about the financial obligations of the government.

- Policy Making: It serves as a reference point for policymakers when crafting fiscal policies.

Understanding the debt clock is essential for anyone interested in the economic well-being of the country. It sheds light on the potential risks associated with excessive borrowing and the importance of fiscal discipline.

How Does the Debt Clock Work?

The debt clock works by collecting data from various government sources, including the U.S. Treasury Department. It calculates the total national debt by adding up all outstanding public and intragovernmental debt. The clock then displays this information in real-time, updating every few seconds to reflect changes in the debt level.

Additionally, the debt clock often includes supplementary information such as:

Read also:Julian Edelmans Weight And Height A Comprehensive Look At The Nfl Star

- Gross Domestic Product (GDP)

- Population

- Per capita debt

This comprehensive approach allows users to gain a deeper understanding of the nation's financial situation.

The History of the US National Debt

The history of the US national debt dates back to the founding of the nation. The first recorded national debt was incurred during the American Revolutionary War, and it has continued to grow over the centuries. Key events such as wars, economic downturns, and government spending have contributed to the expansion of the debt.

According to the Congressional Budget Office (CBO), the national debt has grown significantly in recent decades. Factors such as tax cuts, increased government spending, and economic recessions have all played a role in this growth. As of 2023, the national debt exceeds $31 trillion, a figure that continues to rise.

Major Contributors to the National Debt

Several factors have contributed to the growth of the national debt:

- Military Spending: The United States spends more on defense than any other country, contributing significantly to the debt.

- Social Programs: Programs like Social Security and Medicare require substantial funding, adding to the debt burden.

- Economic Stimulus: During economic downturns, the government often implements stimulus packages, increasing the debt.

These factors highlight the complexity of managing the nation's finances and the challenges faced by policymakers.

Impact of the National Debt on the Economy

The national debt has far-reaching implications for the US economy. It affects interest rates, inflation, and the overall economic growth of the country. High levels of debt can lead to increased borrowing costs, reduced investment, and potential downgrades in the country's credit rating.

According to the Federal Reserve, the growing debt could lead to slower economic growth in the long term. This is because a significant portion of the government's budget is allocated to servicing the debt, leaving less room for investments in infrastructure, education, and other critical areas.

Potential Consequences of High Debt Levels

High debt levels can have several negative consequences:

- Increased Interest Rates: As the government borrows more, interest rates may rise, affecting consumers and businesses.

- Reduced Fiscal Flexibility: A large debt burden limits the government's ability to respond to economic challenges.

- Global Economic Impact: The US dollar's status as a global reserve currency means that its debt levels can affect international markets.

These consequences underscore the importance of managing the debt responsibly and implementing sustainable fiscal policies.

Solutions to Address the National Debt

Addressing the national debt requires a multifaceted approach. Policymakers must balance the need for economic growth with the necessity of reducing the debt burden. Some potential solutions include:

- Tax Reforms: Implementing tax policies that increase revenue without stifling economic growth.

- Spending Cuts: Reducing unnecessary government expenditures to decrease the budget deficit.

- Economic Growth Strategies: Promoting policies that boost economic growth, thereby increasing tax revenues.

These solutions require careful planning and collaboration between lawmakers, economists, and the public to ensure long-term success.

Role of Fiscal Policy in Debt Management

Fiscal policy plays a crucial role in managing the national debt. By adjusting government spending and taxation, policymakers can influence the level of debt. Effective fiscal policies can help stabilize the economy, reduce the debt burden, and promote sustainable growth.

According to the International Monetary Fund (IMF), countries with sound fiscal policies tend to have lower debt levels and stronger economic performance. This highlights the importance of responsible fiscal management in addressing the national debt.

Global Perspectives on the US Dollar Debt Clock

The US Dollar Debt Clock is not just a domestic issue; it has global implications. As the world's largest economy, the financial health of the United States affects international markets and economies. The growing debt levels have raised concerns among global investors and policymakers.

According to the World Bank, the US dollar's role as a global reserve currency means that its debt levels can influence exchange rates, trade balances, and global economic stability. This interconnectedness underscores the importance of addressing the debt issue on a global scale.

How Other Countries Manage Their Debt

Other countries have implemented various strategies to manage their debt levels. For example:

- Germany: Known for its fiscal discipline, Germany has implemented strict budget controls to reduce its debt.

- Japan: Despite having one of the highest debt-to-GDP ratios, Japan has managed its debt through monetary policy and economic reforms.

- Canada: Canada has focused on reducing its debt through a combination of tax reforms and spending cuts.

These examples demonstrate the diverse approaches countries can take to address their debt challenges.

Public Perception of the US Dollar Debt Clock

Public perception of the US Dollar Debt Clock varies widely. Some view it as a critical tool for understanding the nation's financial health, while others see it as a cause for alarm. The clock serves as a reminder of the financial challenges facing the country and the need for responsible fiscal policies.

Surveys conducted by the Pew Research Center indicate that a majority of Americans are concerned about the growing debt levels. This concern is reflected in public discourse and political debates, highlighting the importance of addressing the issue.

How the Debt Clock Influences Public Opinion

The debt clock influences public opinion by providing a tangible representation of the nation's financial situation. It serves as a catalyst for discussions about fiscal responsibility and the role of government in managing the economy. By raising awareness, the debt clock encourages citizens to engage in conversations about the future of the country's finances.

Conclusion

The US Dollar Debt Clock is a vital tool for understanding the financial health of the United States. It provides real-time insights into the nation's growing debt and its implications for the economy. By tracking the debt, the clock promotes transparency and public awareness, encouraging discussions about fiscal responsibility.

As the debt continues to rise, it is essential for policymakers to implement sustainable solutions that address the issue without compromising economic growth. This article has explored the significance of the debt clock, its history, and the potential consequences of high debt levels. We encourage readers to share their thoughts and engage in conversations about the future of the US economy.

Call to Action: Leave a comment below with your thoughts on the US Dollar Debt Clock. Share this article with others who may be interested in understanding the financial health of the nation.

Table of Contents

- What is the US Dollar Debt Clock?

- Why is the US Dollar Debt Clock Important?

- How Does the Debt Clock Work?

- The History of the US National Debt

- Major Contributors to the National Debt

- Impact of the National Debt on the Economy

- Potential Consequences of High Debt Levels

- Solutions to Address the National Debt

- Role of Fiscal Policy in Debt Management

- Global Perspectives on the US Dollar Debt Clock

- How Other Countries Manage Their Debt

- Public Perception of the US Dollar Debt Clock

- How the Debt Clock Influences Public Opinion

- Conclusion