When it comes to managing finances and adhering to tax obligations, understanding the state of Virginia Taxation Department is crucial for residents and businesses alike. The department plays a pivotal role in ensuring fair taxation practices and providing resources for taxpayers. This article delves into the intricacies of the Virginia Taxation Department, offering valuable insights for individuals seeking clarity on their tax responsibilities.

The state of Virginia Taxation Department is a government entity tasked with overseeing tax collection, enforcement, and administration within the Commonwealth. Its primary goal is to ensure compliance while offering support to taxpayers. This department is responsible for administering various types of taxes, including income tax, sales tax, and property tax, among others.

By understanding the functions and services provided by the Virginia Taxation Department, taxpayers can better navigate the complexities of the tax system. This guide aims to provide a detailed overview, ensuring that individuals and businesses are well-informed about their obligations and rights under Virginia tax law.

Read also:Hello Kitty And Friends Characters Names A Comprehensive Guide

Table of Contents

- Introduction to Virginia Taxation Department

- Types of Taxes in Virginia

- The Tax Filing Process

- Tax Relief Programs

- Penalties for Non-Compliance

- Resources for Taxpayers

- Understanding the Audit Process

- Recent Tax Reforms in Virginia

- Federal vs. State Taxation

- Conclusion and Next Steps

Introduction to Virginia Taxation Department

The Virginia Department of Taxation serves as the central authority for tax-related matters in the Commonwealth. Established to streamline the tax collection process, the department focuses on ensuring transparency and fairness in its operations. It collaborates with federal agencies and local governments to administer tax laws effectively.

One of the key responsibilities of the Virginia Taxation Department is to provide educational resources for taxpayers. These resources include online tools, publications, and workshops designed to help individuals and businesses understand their tax obligations. By promoting awareness, the department aims to reduce the incidence of non-compliance and improve overall taxpayer satisfaction.

In addition to its administrative duties, the Virginia Taxation Department also plays a role in shaping tax policy. Through research and analysis, the department identifies areas for improvement and recommends changes to existing laws. This proactive approach ensures that the tax system remains relevant and responsive to the needs of the community.

Types of Taxes in Virginia

Virginia imposes several types of taxes to fund public services and infrastructure. Understanding these taxes is essential for residents and businesses to plan their finances effectively.

Income Tax

Virginia's personal income tax applies to individuals, estates, and trusts. The tax rate varies based on income levels, with a maximum rate of 5.75%. Employers are required to withhold state income tax from employee wages, ensuring timely payment to the Department of Taxation.

Sales Tax

The Commonwealth imposes a general sales and use tax of 4.3%. Certain localities may add additional taxes, bringing the total rate to 6% or higher. Sales tax applies to most retail purchases, with some exemptions for groceries and prescription medications.

Read also:Santa Clarita Population 2023 An Indepth Analysis And Insights

Property Tax

Property taxes in Virginia are levied by local governments rather than the state. These taxes are based on the assessed value of real estate and personal property. Property owners receive annual tax bills, which must be paid promptly to avoid penalties.

The Tax Filing Process

Filing taxes in Virginia involves several steps, including gathering necessary documents, calculating tax liability, and submitting the return. The Virginia Department of Taxation offers multiple filing options to accommodate taxpayers' preferences.

Individuals can file their taxes electronically using certified software or through the department's online portal. This method ensures faster processing and reduces the risk of errors. Alternatively, taxpayers may opt for paper filing by submitting Form 760, the Virginia Individual Income Tax Return.

Businesses must file separate returns for income, sales, and other applicable taxes. The department provides specific forms and instructions for each type of return, ensuring compliance with state regulations.

Tax Relief Programs

Recognizing that some taxpayers may face financial hardships, the Virginia Taxation Department offers various relief programs. These programs aim to alleviate the burden of tax obligations for eligible individuals and businesses.

- Homestead Exemption: Provides property tax relief for homeowners aged 65 or older or those with disabilities.

- Low-Income Tax Credit: Offers credits to low-income taxpayers, reducing their overall tax liability.

- Business Assistance: Includes deferral options and reduced penalties for businesses affected by economic downturns.

Taxpayers interested in these programs should review the eligibility criteria and application process outlined by the department. Seeking professional advice may also be beneficial to ensure proper utilization of available resources.

Penalties for Non-Compliance

Failing to comply with Virginia tax laws can result in significant penalties. The Department of Taxation imposes fines and interest charges for late filings, underpayments, and other violations. These penalties are designed to encourage timely compliance and discourage deliberate avoidance.

In addition to monetary penalties, non-compliance may lead to legal consequences, including liens, levies, or even criminal prosecution in severe cases. Taxpayers are advised to address any discrepancies promptly and seek assistance if needed to avoid escalating issues.

Resources for Taxpayers

The Virginia Taxation Department provides a wealth of resources to assist taxpayers in fulfilling their obligations. These resources include:

- Online Tools: Interactive calculators and filing portals for convenience.

- Publications: Comprehensive guides and brochures covering various tax topics.

- Customer Support: Dedicated phone lines and email addresses for inquiries.

By leveraging these resources, taxpayers can gain a deeper understanding of the tax system and improve their compliance efforts. The department also encourages feedback to enhance its services continuously.

Understanding the Audit Process

Audits are an essential part of the tax system, ensuring that taxpayers accurately report their income and deductions. The Virginia Department of Taxation conducts audits to verify compliance with state laws.

The audit process typically begins with a notification letter outlining the scope of the review. Taxpayers are required to provide requested documentation within a specified timeframe. Cooperation during the audit is crucial to resolving any discrepancies efficiently.

While audits can be intimidating, maintaining accurate records and seeking professional assistance can alleviate much of the stress associated with the process. Understanding the rights and responsibilities during an audit is equally important for a positive outcome.

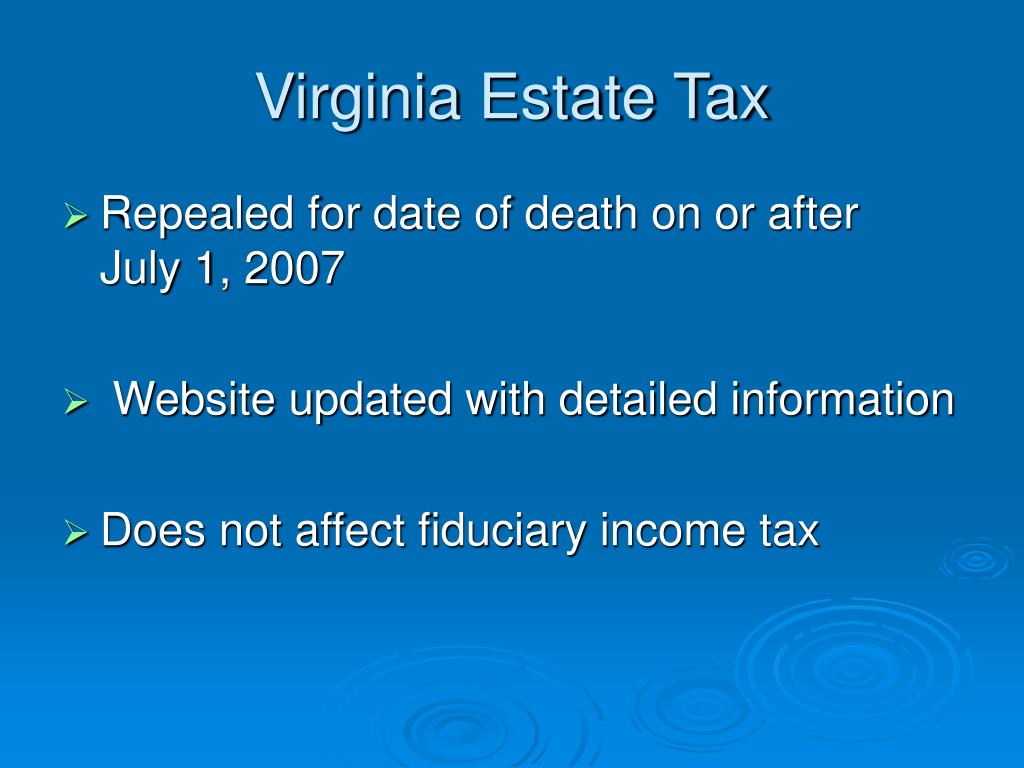

Recent Tax Reforms in Virginia

Virginia has implemented several tax reforms in recent years to enhance fairness and efficiency. These reforms address emerging economic challenges and align the tax system with modern standards.

One notable reform involves updating sales tax regulations to include digital goods and services. This change ensures that all forms of commerce contribute equitably to state revenue. Additionally, the department has streamlined the filing process by adopting advanced technology solutions.

Taxpayers should stay informed about these reforms to adjust their strategies accordingly. Subscribing to the department's newsletter or visiting its website regularly can help individuals remain up-to-date with the latest developments.

Federal vs. State Taxation

While both federal and state tax systems aim to generate revenue, they differ significantly in structure and administration. Federal taxes are governed by the Internal Revenue Service (IRS), whereas state taxes fall under the jurisdiction of entities like the Virginia Department of Taxation.

Key differences include:

- Tax Rates: Federal rates are generally higher but offer more deductions and credits.

- Filing Deadlines: State deadlines may vary slightly from federal deadlines.

- Services Funded: State taxes primarily support local infrastructure and services, while federal taxes fund national programs.

Coordinating federal and state tax obligations requires careful planning and attention to detail. Consulting a tax professional can help ensure compliance with both systems.

Conclusion and Next Steps

In conclusion, the Virginia Taxation Department plays a vital role in maintaining a fair and efficient tax system. By understanding the types of taxes, filing processes, and available resources, taxpayers can meet their obligations with confidence. Staying informed about recent reforms and leveraging department resources will further enhance compliance efforts.

We encourage readers to take action by reviewing their current tax strategies and exploring opportunities for improvement. Share this article with others who may benefit from the information, and consider exploring additional resources provided by the Virginia Department of Taxation. Together, we can promote a culture of transparency and responsibility in tax matters.