In today's digital banking era, understanding financial terminology is crucial for managing your finances effectively. One such term that often arises is "ABA number." If you're wondering what an ABA number is and why it's important, this article will provide a thorough explanation. An ABA number, also known as a routing transit number (RTN), plays a pivotal role in facilitating smooth transactions within the U.S. banking system.

Whether you're setting up direct deposits, paying bills online, or transferring funds between accounts, knowing your ABA number is essential. This guide will delve into the intricacies of ABA numbers, their purpose, and how they function in the financial ecosystem.

By the end of this article, you'll have a clear understanding of ABA numbers, their significance, and how to locate and use them effectively. Let's get started!

Read also:Capital One Customer Service Number Your Ultimate Guide To Seamless Banking Support

Table of Contents:

- What is an ABA Number?

- History of ABA Numbers

- ABA Number Format

- How to Find Your ABA Number

- Common Uses of ABA Numbers

- ABA Number vs. SWIFT Code

- Security Concerns with ABA Numbers

- Changes in ABA Numbers

- Common Errors with ABA Numbers

- Frequently Asked Questions About ABA Numbers

What is an ABA Number?

An ABA number, or American Bankers Association number, is a unique 9-digit code assigned to financial institutions in the United States. This number serves as an identification marker for banks and credit unions, allowing them to process transactions efficiently. The ABA number ensures that funds are routed to the correct institution during transfers, checks, or other financial activities.

Also referred to as a routing transit number (RTN), the ABA number is primarily used for domestic transactions within the U.S. It plays a crucial role in maintaining the integrity and accuracy of financial transactions, ensuring that payments and transfers are completed without errors.

Importance of ABA Numbers in Banking

ABA numbers are vital for various banking operations, including:

- Direct deposit of paychecks

- Automated Clearing House (ACH) transactions

- Wire transfers

- Check processing

Without an ABA number, banks would face significant challenges in identifying and routing transactions accurately.

History of ABA Numbers

The concept of ABA numbers dates back to 1910 when the American Bankers Association introduced them to streamline check processing. At the time, the banking system was growing rapidly, and there was a need for a standardized method to identify financial institutions. The ABA number system was created to address this need, providing a unique identifier for each bank or credit union.

Read also:Is James Charles Still Alive Unveiling The Truth Behind The Viral Sensation

Evolution of ABA Numbers

Over the years, the use of ABA numbers has expanded beyond check processing. With the advent of electronic banking and online transactions, ABA numbers have become essential for various financial activities. Today, they are used for ACH transfers, direct deposits, and other electronic payment systems.

ABA Number Format

An ABA number consists of nine digits, each serving a specific purpose:

- First four digits: Represent the Federal Reserve Routing Symbol.

- Fifth and sixth digits: Identify the bank's location and region.

- Seventh digit: Indicates the bank's Federal Reserve District.

- Eighth and ninth digits: Act as a checksum to validate the ABA number.

This structured format ensures that ABA numbers are unique and easily verifiable, reducing the risk of errors in financial transactions.

How to Find Your ABA Number

Locating your ABA number is a straightforward process. Here are some common methods:

1. Check Your Checkbook

One of the easiest ways to find your ABA number is by looking at the bottom of your checks. The ABA number is typically the first set of numbers on the left-hand side.

2. Online Banking

Most banks provide ABA numbers through their online banking portals. Simply log in to your account and navigate to the account information section to find your ABA number.

3. Contact Your Bank

If you're unable to locate your ABA number, you can contact your bank's customer service for assistance. They will be able to provide you with the correct ABA number for your account.

Common Uses of ABA Numbers

ABA numbers are utilized in various financial transactions. Here are some of the most common uses:

- Direct Deposits: Employers use ABA numbers to deposit employee salaries directly into their bank accounts.

- ACH Transfers: ABA numbers are essential for processing Automated Clearing House transactions, such as bill payments and fund transfers.

- Wire Transfers: While ABA numbers are primarily used for domestic transactions, they can also facilitate certain types of wire transfers within the U.S.

Understanding the specific use cases for ABA numbers can help you manage your finances more effectively.

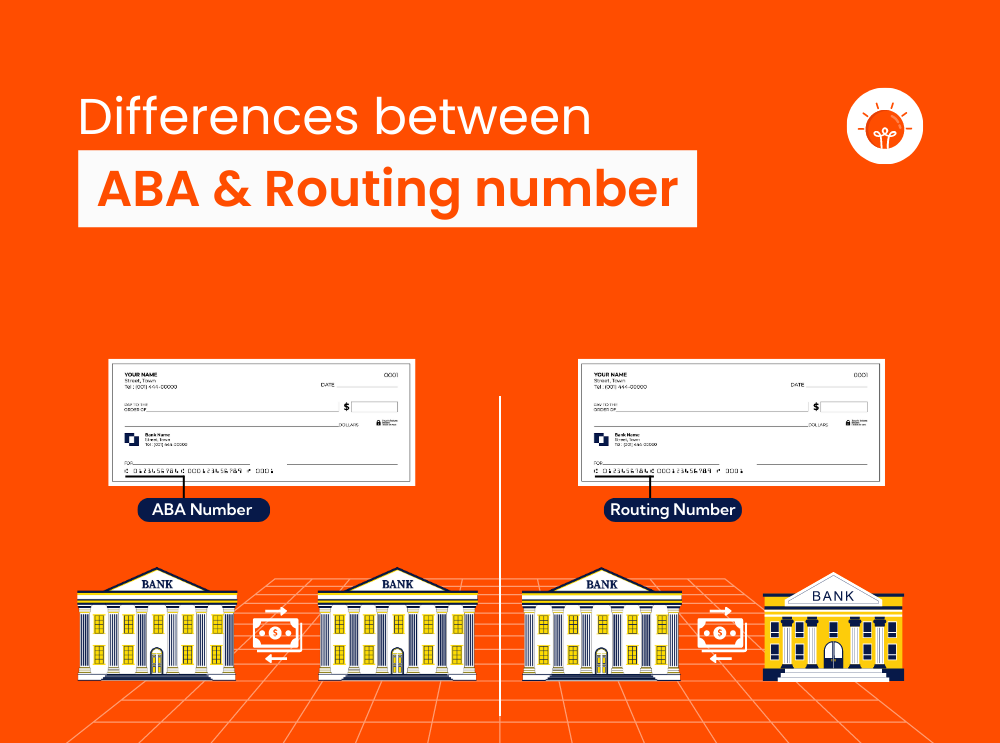

ABA Number vs. SWIFT Code

While ABA numbers are used for domestic transactions, SWIFT codes are utilized for international transfers. Here's a brief comparison:

- ABA Number: 9-digit code used for U.S. transactions.

- SWIFT Code: 8-11 character alphanumeric code used for global transactions.

It's important to use the correct code based on the type of transaction you're conducting. For example, if you're transferring funds internationally, you'll need a SWIFT code instead of an ABA number.

Key Differences Between ABA and SWIFT Codes

The primary distinction between ABA numbers and SWIFT codes lies in their geographical scope and application. ABA numbers are domestic, while SWIFT codes are international. Additionally, SWIFT codes include both letters and numbers, whereas ABA numbers consist solely of digits.

Security Concerns with ABA Numbers

While ABA numbers are essential for financial transactions, they can also pose security risks if not handled properly. Sharing your ABA number with unauthorized parties may lead to fraudulent activities or unauthorized access to your account.

Best Practices for Protecting Your ABA Number

- Only share your ABA number with trusted entities.

- Regularly monitor your account for suspicious activity.

- Use secure channels when transmitting sensitive financial information.

By following these precautions, you can safeguard your ABA number and protect your financial information.

Changes in ABA Numbers

In some cases, banks may change their ABA numbers due to mergers, acquisitions, or other organizational changes. If your bank undergoes such a change, it's important to update your records and notify any entities that rely on your ABA number for transactions.

How to Handle ABA Number Changes

- Contact your bank to confirm the new ABA number.

- Update your payroll information with your employer.

- Notify utility companies and other entities that use your ABA number for automatic payments.

Staying informed about ABA number changes can help prevent disruptions in your financial transactions.

Common Errors with ABA Numbers

Mistakes in ABA numbers can lead to failed transactions or delays in processing. Some common errors include:

- Transposing digits in the ABA number.

- Using an outdated or incorrect ABA number.

- Providing the wrong ABA number for international transactions.

To avoid these errors, always double-check the ABA number before initiating a transaction. Additionally, consult your bank if you're unsure about the correct ABA number to use.

Frequently Asked Questions About ABA Numbers

1. Can I use my ABA number for international transactions?

No, ABA numbers are only used for domestic transactions within the U.S. For international transfers, you'll need a SWIFT code.

2. How do I find my ABA number if I don't have checks?

You can find your ABA number through your bank's online portal or by contacting customer service.

3. What happens if I provide the wrong ABA number?

Providing an incorrect ABA number can result in failed transactions or delays in processing. Always verify the ABA number before initiating a transaction.

4. Are ABA numbers unique to each bank account?

No, ABA numbers are unique to each financial institution, not individual accounts. However, some banks may have multiple ABA numbers for different types of transactions.

5. Can I change my ABA number?

ABA numbers are assigned to banks, not individual accounts. Therefore, you cannot change your ABA number unless your bank undergoes a change that affects its ABA number.

Conclusion

In conclusion, understanding what an ABA number is and how it functions is essential for managing your finances effectively. From facilitating direct deposits to ensuring accurate check processing, ABA numbers play a critical role in the U.S. banking system.

We encourage you to take the following actions:

- Verify your ABA number and ensure it's up-to-date.

- Implement security measures to protect your ABA number.

- Share this article with others to help them understand the importance of ABA numbers.

For more information on financial topics, explore our other articles and resources. Your feedback and questions are always welcome in the comments section below!