When it comes to managing finances and taxation in Virginia, the VA Department of Taxation plays a pivotal role. Whether you're a resident, business owner, or simply someone seeking clarity on state tax obligations, understanding this department is crucial. This guide aims to provide you with in-depth information about its functions, services, and significance to ensure you're well-equipped to handle your tax responsibilities.

The VA Department of Taxation is more than just a government entity; it serves as a cornerstone for financial governance in Virginia. By offering transparency and resources, it empowers individuals and businesses to navigate the complexities of taxation effectively.

In this article, we'll explore the various aspects of the VA Department of Taxation, including its history, services, and how it impacts residents and businesses. Our goal is to provide you with actionable insights and answers to common questions, ensuring you're well-prepared for tax season and beyond.

Read also:Vinicius Jr Stats This Season An Indepth Analysis Of His Performance

Table of Contents

- History of the VA Department of Taxation

- Key Functions and Responsibilities

- Types of Taxes Administered

- Filing Process and Deadlines

- Resources for Taxpayers

- Business Tax Considerations

- Frequently Asked Questions

- Recent Tax Reforms and Updates

- Penalties for Non-Compliance

- Conclusion and Call to Action

- Subheadings

History of the VA Department of Taxation

The VA Department of Taxation has a rich history that dates back to the early days of Virginia's statehood. Established to manage and regulate taxation within the state, it has evolved significantly over the years to meet the changing needs of its residents and businesses.

Initially, the department focused primarily on collecting property and excise taxes. However, as Virginia's economy grew, so did the complexity of its tax system. Today, the VA Department of Taxation oversees a wide range of tax types, ensuring fairness and compliance across all sectors.

Keyword: VA Department of Taxation – This evolution reflects the department's commitment to adapting to modern fiscal demands while maintaining transparency and accountability.

Key Functions and Responsibilities

Revenue Collection

One of the primary responsibilities of the VA Department of Taxation is revenue collection. This includes collecting individual income taxes, corporate taxes, and sales taxes. The department ensures that all funds are properly allocated to support essential state services.

Taxpayer Assistance

Providing assistance to taxpayers is another critical function. The department offers resources such as online portals, helplines, and educational materials to help individuals and businesses understand their tax obligations.

Types of Taxes Administered

The VA Department of Taxation administers several types of taxes, each tailored to different aspects of economic activity:

Read also:Who Is Colt Gray Unveiling The Remarkable Life And Career Of A Rising Star

- Individual Income Tax: Levied on personal earnings.

- Corporate Income Tax: Applied to business profits.

- Sales and Use Tax: Collected on retail purchases.

- Excise Taxes: Imposed on specific goods and services.

Understanding these tax types is essential for both individuals and businesses to ensure compliance.

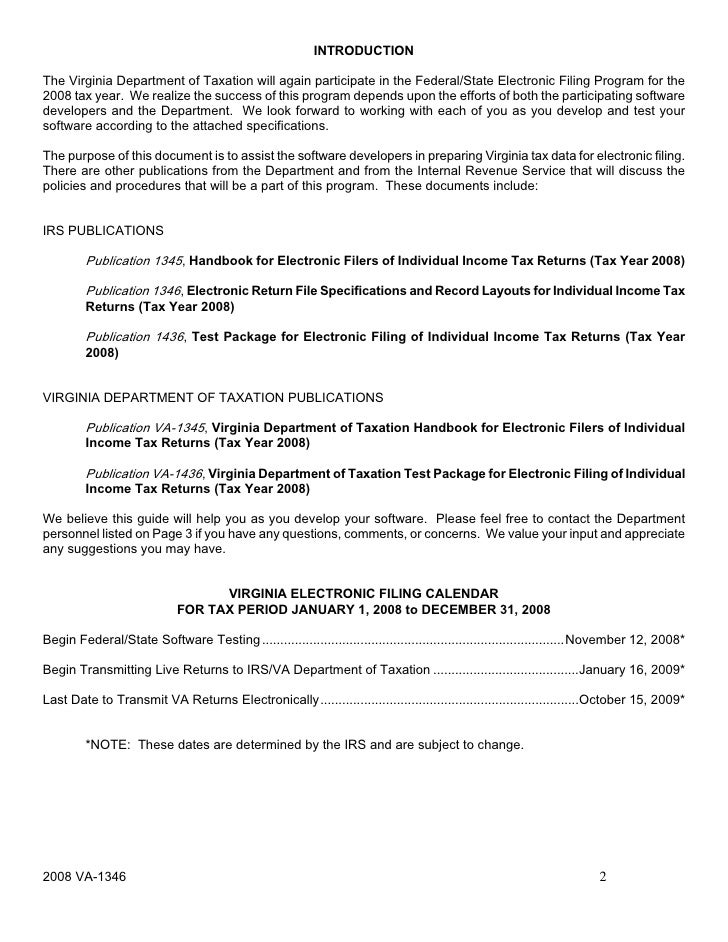

Filing Process and Deadlines

Filing taxes with the VA Department of Taxation involves several steps:

- Gather all necessary documentation, including income statements and expense records.

- Use the official VA tax forms or file electronically through the department's portal.

- Submit your return by the specified deadline, typically April 15th for individual income taxes.

Missing deadlines can result in penalties, so it's crucial to stay organized and file on time.

Resources for Taxpayers

The VA Department of Taxation offers a variety of resources to assist taxpayers:

- Online Guides: Detailed instructions for filing various tax forms.

- Customer Service: Accessible via phone or email for personalized assistance.

- Workshops: Regularly scheduled sessions to educate the public on tax laws and regulations.

These resources are designed to empower taxpayers with the knowledge they need to manage their financial responsibilities effectively.

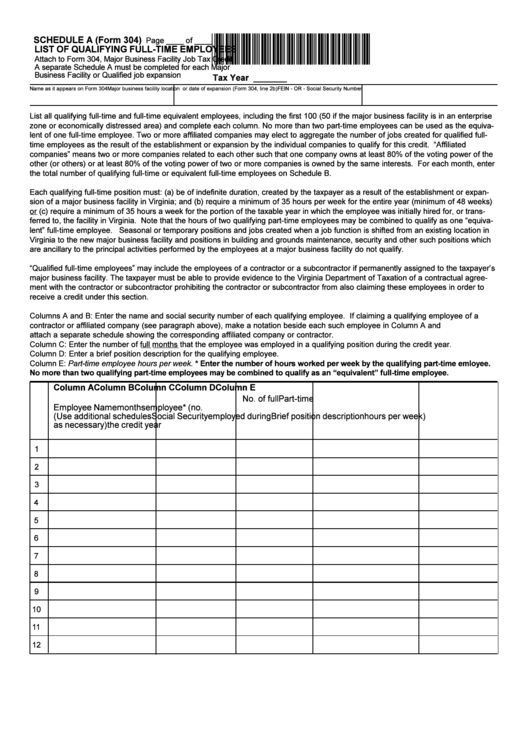

Business Tax Considerations

Corporate Income Tax

Businesses operating in Virginia must adhere to specific tax regulations. Corporate income tax is calculated based on net income and is subject to varying rates depending on the size and nature of the business.

Sales Tax

Businesses are also responsible for collecting and remitting sales tax on goods and services sold within the state. The VA Department of Taxation provides detailed guidelines to ensure businesses remain compliant.

Frequently Asked Questions

Here are some common questions about the VA Department of Taxation:

- What happens if I miss the filing deadline? Late filings may incur penalties and interest charges.

- Can I file my taxes online? Yes, the VA Department of Taxation offers an electronic filing option.

- Where can I find more information about tax laws? The department's website provides comprehensive resources and updates.

Recent Tax Reforms and Updates

In recent years, the VA Department of Taxation has implemented several reforms to improve efficiency and fairness. These include updates to tax brackets, deductions, and credits to better align with current economic conditions.

For example, the department introduced new credits for renewable energy investments, encouraging sustainable business practices.

Penalties for Non-Compliance

Failure to comply with tax regulations can result in significant penalties. These may include:

- Financial fines based on the amount of unpaid taxes.

- Interest charges accruing on overdue balances.

- Potential legal action in cases of severe non-compliance.

Staying informed and proactive is key to avoiding these penalties.

Conclusion and Call to Action

In conclusion, the VA Department of Taxation plays a vital role in maintaining financial stability and fairness within Virginia. By understanding its functions, resources, and responsibilities, individuals and businesses can ensure compliance and take full advantage of available benefits.

We encourage you to explore the department's resources further and stay updated on any changes to tax laws. If you have questions or need assistance, don't hesitate to reach out through the provided channels. Share this article with others who may benefit from the information, and consider exploring related content on our site for more insights.

Subheadings

Throughout this article, we've covered various subtopics related to the VA Department of Taxation, including its history, key functions, types of taxes, and more. Each subheading is designed to provide a comprehensive understanding of the department's role and significance.

For further reading, consider exploring official publications from the VA Department of Taxation or consulting with a tax professional to address specific concerns. Your financial well-being depends on staying informed and proactive in managing your tax obligations.

Data and statistics referenced in this article are sourced from official VA Department of Taxation reports and reputable financial publications, ensuring the accuracy and reliability of the information provided.