Montana Dept of Revenue plays a crucial role in managing the financial infrastructure of the state. As one of the key government agencies, it is responsible for ensuring compliance with tax laws, administering revenue programs, and providing essential services to taxpayers. Whether you're a resident, business owner, or simply someone interested in the state's fiscal policies, understanding the Montana Dept of Revenue is vital for navigating Montana's financial landscape.

Montana is known for its breathtaking landscapes and vibrant communities, but behind the scenes, the state's economic stability depends on efficient revenue management. The Montana Dept of Revenue serves as the backbone of this system, ensuring that funds are collected, distributed, and accounted for in a transparent and equitable manner. This article aims to provide an in-depth exploration of the department's functions, responsibilities, and the resources available to the public.

From tax regulations to licensing services, the Montana Dept of Revenue touches many aspects of daily life for Montanans. Whether you're filing your annual taxes, registering a vehicle, or starting a new business, this department plays a pivotal role. By the end of this article, you'll have a clear understanding of how the Montana Dept of Revenue operates and how it impacts you.

Read also:Who Is Colt Gray Unveiling The Remarkable Life And Career Of A Rising Star

Table of Contents

- Introduction to Montana Dept of Revenue

- Key Functions and Responsibilities

- Montana's Tax System Overview

- Revenue Programs Administered by the Department

- Licensing and Registration Services

- Ensuring Compliance and Enforcement

- Resources and Tools for Taxpayers

- Online Services and Digital Transformation

- Current Challenges and Future Plans

- Conclusion and Call to Action

Introduction to Montana Dept of Revenue

The Montana Dept of Revenue is a state agency tasked with overseeing financial matters related to taxation, revenue collection, and compliance. Established to streamline the state's fiscal operations, the department works tirelessly to ensure that all revenue streams are managed effectively. Its mission is to promote fairness, transparency, and accountability in the administration of Montana's financial systems.

History and Evolution

The department has a long history dating back to the early days of Montana's statehood. Over the years, it has evolved to adapt to changing economic conditions and technological advancements. Today, the Montana Dept of Revenue leverages modern tools and systems to enhance its services, making it easier for residents and businesses to fulfill their financial obligations.

Why It Matters

Understanding the Montana Dept of Revenue is essential for anyone living or doing business in the state. The department's work directly affects various aspects of daily life, from personal income taxes to business licensing. By staying informed, individuals and organizations can ensure compliance and take advantage of the resources available.

Key Functions and Responsibilities

The Montana Dept of Revenue performs several critical functions that contribute to the state's financial health. These responsibilities encompass a wide range of activities, all aimed at maintaining a robust and equitable revenue system.

Tax Collection

One of the primary roles of the department is to collect taxes. This includes:

- Individual income tax

- Corporate income tax

- Excise taxes

- Sales and use taxes

Each of these tax types plays a vital role in funding state programs and services.

Read also:Who Is The Highest Paid Wnba Player Discover The Stars Of Womens Basketball

Revenue Management

The department also manages the revenue generated from various sources. This involves tracking funds, ensuring proper allocation, and reporting on financial activities. Effective revenue management helps maintain the state's fiscal stability and supports long-term planning.

Montana's Tax System Overview

Montana's tax system is designed to be fair and efficient, ensuring that all residents contribute to the state's financial well-being. The Montana Dept of Revenue oversees this system, ensuring compliance and addressing any issues that arise.

Types of Taxes

Montana imposes several types of taxes, including:

- Income Tax: Both individuals and corporations are subject to income tax, with rates varying based on income levels.

- Sales Tax: Unlike many states, Montana does not have a statewide sales tax. However, some local governments may impose their own sales taxes.

- Excise Taxes: These taxes apply to specific goods and services, such as fuel, tobacco, and alcohol.

Tax Exemptions and Credits

The state offers various exemptions and credits to help alleviate the tax burden for certain groups. These include:

- Senior citizen property tax exemptions

- Low-income family tax credits

- Business investment tax credits

Revenue Programs Administered by the Department

The Montana Dept of Revenue administers several programs aimed at generating revenue and supporting economic development. These programs are designed to align with the state's goals and priorities.

Property Tax Assistance Programs

Property taxes are a significant source of revenue for local governments in Montana. The department administers programs to assist property owners, such as:

- Homestead Credit

- Disaster Relief Assistance

Energy Incentive Programs

To encourage sustainable development, the department offers incentives for renewable energy projects. These programs provide financial benefits to businesses and individuals investing in clean energy solutions.

Licensing and Registration Services

The Montana Dept of Revenue provides essential licensing and registration services to residents and businesses. These services ensure that all entities operating within the state comply with legal requirements.

Vehicle Registration

One of the most common services offered by the department is vehicle registration. Residents must register their vehicles annually and pay the associated fees. The department also handles title transfers and duplicate titles.

Business Licensing

Businesses operating in Montana must obtain the necessary licenses and permits. The department assists with this process, ensuring that all legal requirements are met.

Ensuring Compliance and Enforcement

Compliance is a critical aspect of the Montana Dept of Revenue's operations. The department employs various strategies to ensure that all individuals and businesses adhere to tax laws and regulations.

Audit Procedures

Regular audits are conducted to verify the accuracy of tax filings. These audits help identify discrepancies and ensure that all parties are paying their fair share.

Enforcement Actions

In cases of non-compliance, the department may take enforcement actions, such as imposing penalties or initiating legal proceedings. These measures are necessary to maintain the integrity of the revenue system.

Resources and Tools for Taxpayers

The Montana Dept of Revenue provides a wealth of resources to assist taxpayers in fulfilling their obligations. These resources are designed to be user-friendly and accessible to all.

Publications and Guides

The department publishes numerous guides and manuals to help taxpayers navigate the complex world of taxation. These resources cover a wide range of topics, from filing instructions to tax law updates.

Customer Support

Taxpayers can access customer support through various channels, including phone, email, and in-person visits. The department's staff is trained to provide clear and accurate information to assist with any questions or concerns.

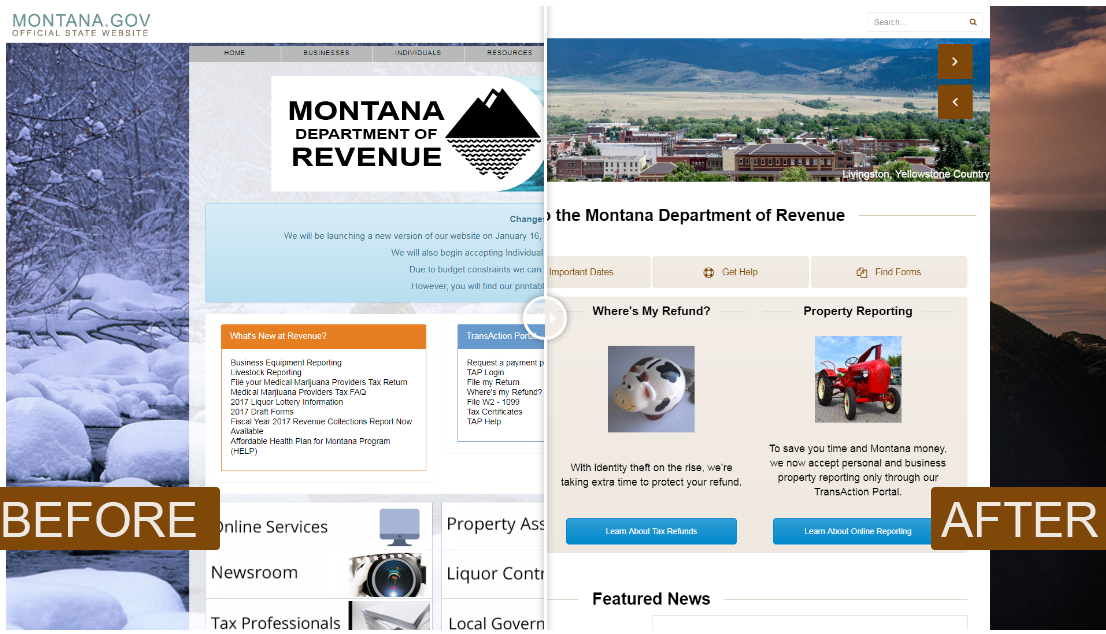

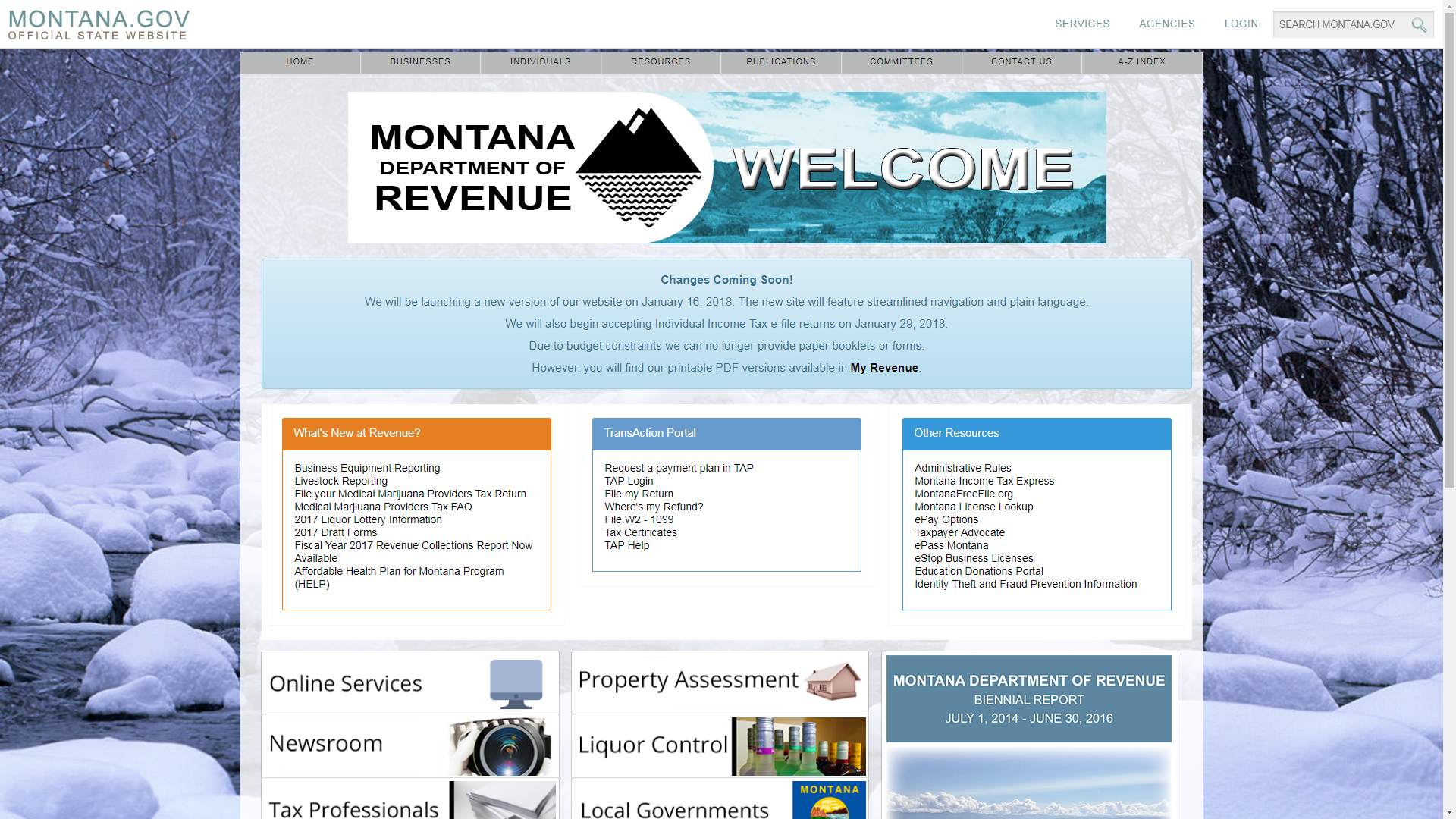

Online Services and Digital Transformation

In recent years, the Montana Dept of Revenue has embraced digital transformation to enhance its services. Online platforms now offer convenient and efficient ways for residents and businesses to interact with the department.

Electronic Filing

Taxpayers can file their returns electronically, reducing the need for paper-based processes. This not only saves time but also improves accuracy and reduces errors.

Secure Payment Options

The department offers secure payment options for taxes and fees, allowing users to pay online with confidence. These options include credit cards, debit cards, and electronic funds transfers.

Current Challenges and Future Plans

Like any government agency, the Montana Dept of Revenue faces challenges in its mission to manage the state's revenue effectively. However, the department is committed to addressing these challenges and implementing innovative solutions.

Technological Advancements

One of the key areas of focus is the continued integration of technology into department operations. By adopting cutting-edge solutions, the department aims to improve efficiency and enhance the user experience.

Public Awareness

Increasing public awareness of the department's services and resources is another priority. Through outreach programs and educational initiatives, the department hopes to ensure that all Montanans have the information they need to comply with tax laws.

Conclusion and Call to Action

The Montana Dept of Revenue plays a vital role in maintaining the state's financial health. By understanding its functions and responsibilities, residents and businesses can better navigate the complexities of taxation and revenue management. Whether you're filing your taxes, registering a vehicle, or starting a new business, the department provides the tools and resources you need to succeed.

We encourage you to explore the resources available on the department's website and take advantage of the online services offered. If you have any questions or concerns, don't hesitate to reach out to customer support for assistance. Together, we can ensure that Montana's revenue system remains strong and equitable for all.

Please share this article with others who may benefit from the information provided. Your feedback is also valuable, so feel free to leave a comment below. Thank you for reading, and stay informed about the important work of the Montana Dept of Revenue!