Chase Bank checking support plays a pivotal role in ensuring customers receive the necessary assistance to manage their accounts effectively. Whether you're dealing with account inquiries, transaction disputes, or technical issues, Chase Bank offers a robust support system to cater to your needs. This guide aims to provide an in-depth understanding of Chase Bank's checking support services, empowering you to make informed decisions about your financial management.

As one of the largest financial institutions in the United States, Chase Bank has built a reputation for offering reliable banking solutions. With a vast network of branches and digital platforms, the bank ensures that its customers have access to comprehensive support whenever they need it. This article will explore the various aspects of Chase Bank's checking support, including the tools, resources, and channels available to assist customers.

Whether you're a new customer or a long-time account holder, understanding how Chase Bank's checking support works can enhance your banking experience. From troubleshooting common issues to leveraging advanced features, this guide will walk you through everything you need to know to maximize your account's potential.

Read also:Santa Clarita Population 2023 An Indepth Analysis And Insights

Table of Contents

- Introduction to Chase Bank Checking Support

- Benefits of Chase Bank Checking Support

- Support Channels Available

- Common Issues and Solutions

- Online Support Resources

- Customer Service Experience

- Security Features and Support

- Frequently Asked Questions

- Tips for Efficient Support Utilization

- Conclusion and Call to Action

Introduction to Chase Bank Checking Support

Chase Bank checking support is designed to assist customers with a wide range of account-related issues. From basic inquiries to complex financial matters, the support team is equipped to provide timely and effective solutions. Understanding the scope of these services is essential for anyone looking to optimize their banking experience.

Understanding the Role of Support

Chase Bank's checking support team acts as a bridge between customers and the bank's financial systems. They help resolve issues related to deposits, withdrawals, account statements, and more. By leveraging advanced technology and a knowledgeable workforce, Chase ensures that its customers receive personalized assistance.

Key Features of Checking Support

- 24/7 availability for urgent inquiries

- Multi-channel support options

- Specialized assistance for business accounts

- Real-time updates on account status

Benefits of Chase Bank Checking Support

One of the standout features of Chase Bank checking support is its ability to address customer needs efficiently. Below are some of the key benefits that make this service invaluable:

Read also:Julian Edelmans Weight And Height A Comprehensive Look At The Nfl Star

Convenience and Accessibility

With multiple channels available, including phone, email, and live chat, customers can reach out to Chase Bank checking support at any time. This flexibility ensures that help is always within reach, regardless of your location or schedule.

Expert Assistance

The support team at Chase Bank consists of trained professionals who are well-versed in banking regulations and account management. Their expertise ensures that customers receive accurate and reliable information.

Support Channels Available

Chase Bank offers a variety of support channels to cater to the diverse needs of its customers. Each channel is designed to provide a seamless experience, ensuring that customers can access the help they need quickly and easily.

Phone Support

For immediate assistance, customers can call Chase Bank's customer service hotline. The phone support team is available 24/7 and can address a wide range of issues, from account verification to transaction disputes.

Online Chat

Chase Bank's online chat feature allows customers to connect with support agents in real-time. This option is ideal for those who prefer instant communication without the need for a phone call.

Common Issues and Solutions

Despite the robust support system, customers may encounter common issues when managing their checking accounts. Below are some of the most frequently reported problems and their corresponding solutions:

Lost or Stolen Debit Cards

In the event of a lost or stolen debit card, customers should immediately contact Chase Bank's support team to report the incident. The bank will then issue a replacement card and monitor the account for any suspicious activity.

Account Freezes

Accounts may be temporarily frozen due to suspected fraudulent activity or non-compliance with bank policies. Customers should verify their identity and resolve any discrepancies to restore access.

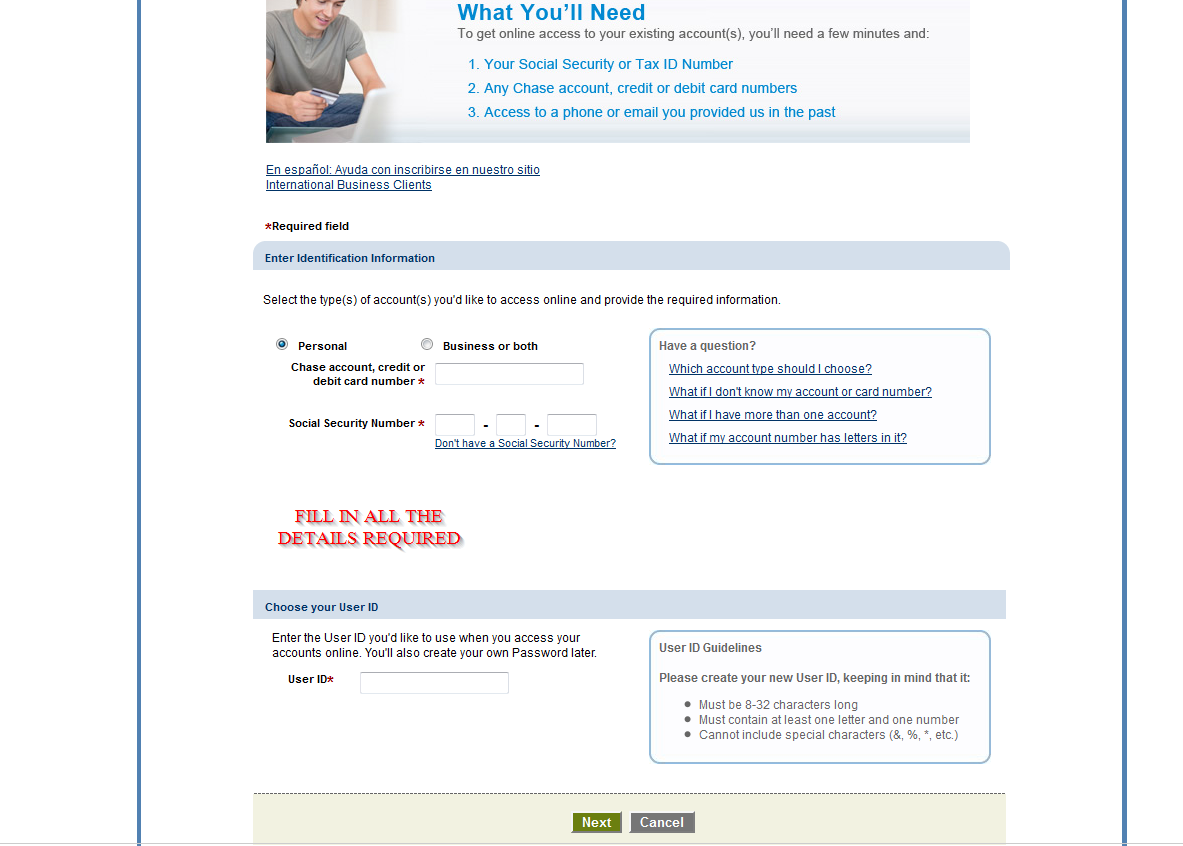

Online Support Resources

Chase Bank provides a wealth of online resources to assist customers with their checking accounts. These tools are designed to enhance user experience and provide self-service options for common issues.

Chase Mobile App

The Chase Mobile App offers a convenient way to manage your checking account on the go. Features include mobile check deposits, account balance checks, and transaction history viewing.

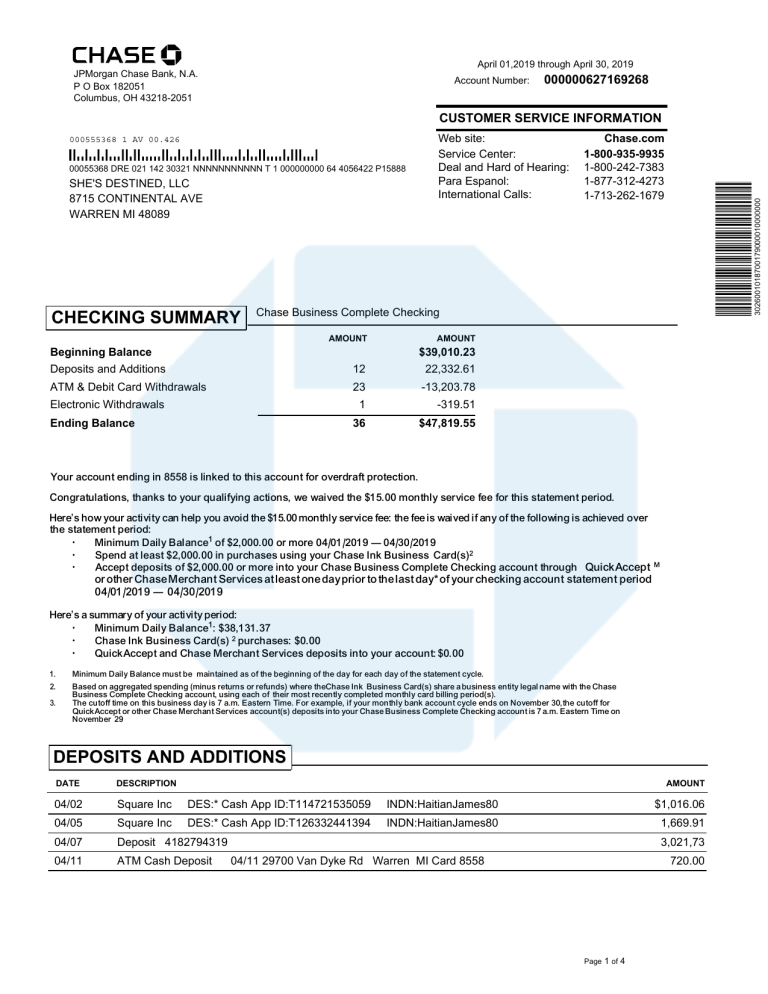

Online Banking Portal

Through the online banking portal, customers can access detailed account information, set up automatic payments, and manage their finances with ease. This platform is secure and user-friendly, making it a popular choice among Chase Bank customers.

Customer Service Experience

Chase Bank prides itself on delivering exceptional customer service. The bank's commitment to quality is reflected in its support processes and interactions with customers.

Customer Feedback

Many customers have praised Chase Bank's checking support for its responsiveness and professionalism. Reviews consistently highlight the team's ability to resolve issues quickly and efficiently.

Continuous Improvement

Chase Bank regularly updates its support systems based on customer feedback and emerging trends. This proactive approach ensures that the bank remains at the forefront of financial innovation.

Security Features and Support

Security is a top priority for Chase Bank, and the checking support team plays a crucial role in maintaining account safety. Below are some of the security features offered by the bank:

Two-Factor Authentication

Chase Bank implements two-factor authentication to verify user identities and prevent unauthorized access. This additional layer of security ensures that only authorized individuals can access customer accounts.

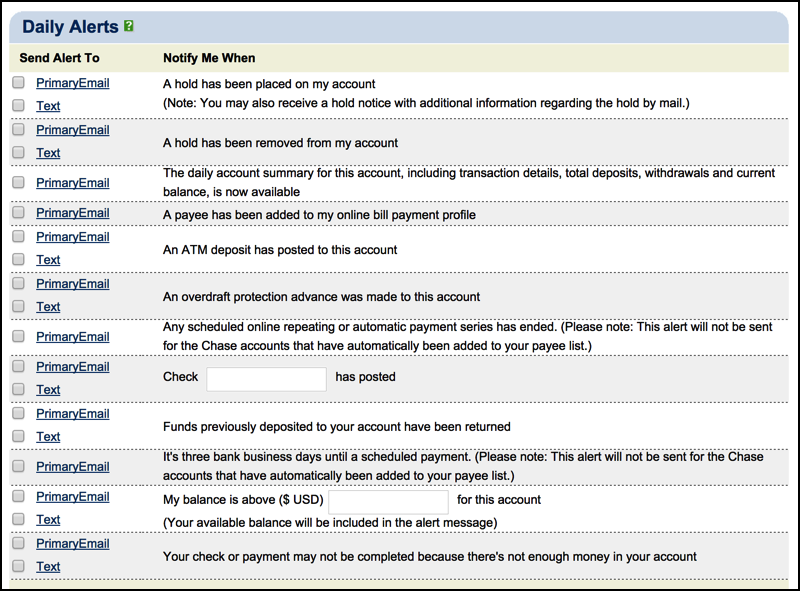

Account Alerts

Customers can set up account alerts to receive notifications about suspicious activity or large transactions. These alerts help customers stay informed and take prompt action if necessary.

Frequently Asked Questions

Below are some of the most commonly asked questions about Chase Bank checking support:

- How do I contact Chase Bank checking support? You can reach out via phone, email, or live chat depending on your preference.

- What should I do if I notice fraudulent activity on my account? Contact Chase Bank immediately to report the issue and initiate an investigation.

- Is there a fee for using checking support services? Most support services are free of charge, but certain specialized services may incur fees.

Tips for Efficient Support Utilization

To make the most of Chase Bank checking support, consider the following tips:

- Keep your account information up-to-date to avoid delays in support.

- Utilize the Chase Mobile App for quick access to account details and support features.

- Document all interactions with support agents for future reference.

Conclusion and Call to Action

In conclusion, Chase Bank checking support offers a comprehensive suite of services designed to meet the needs of its customers. From multi-channel accessibility to advanced security features, the bank ensures that its customers receive the highest level of care and assistance.

We encourage you to explore the resources and tools available through Chase Bank checking support to enhance your banking experience. Feel free to leave a comment or share this article with others who may benefit from the information provided. For more insights into financial management, check out our other articles on the website.

Data Source: Chase Bank Official Website