Travis County Texas property tax records are essential for homeowners, investors, and anyone interested in understanding the financial landscape of real estate in the region. Property tax records provide critical information about property assessments, tax liabilities, and ownership details. Whether you're planning to buy a home, sell an existing property, or simply want to stay informed about your tax obligations, this guide will walk you through everything you need to know about Travis County's property tax system.

Property taxes are one of the primary sources of revenue for local governments. In Travis County, Texas, these funds are used to support public services such as schools, emergency services, infrastructure maintenance, and more. Understanding how property tax records work is vital for making informed decisions about your property investments.

This article will delve into the intricacies of Travis County Texas property tax records, including how to access them, interpret the data, and understand the legal framework governing property taxation. By the end of this guide, you'll have a comprehensive understanding of the property tax system in Travis County and how it impacts you as a property owner or investor.

Read also:Is James Charles Still Alive Unveiling The Truth Behind The Viral Sensation

Table of Contents

- Introduction to Travis County Property Tax Records

- How to Access Travis County Texas Property Tax Records

- Understanding Property Tax Records in Travis County

- Property Assessment Process

- Tax Exemptions and Deductions

- Appealing Property Tax Assessments

- Managing Tax Delinquency

- How Property Taxes Fund Public Services

- Legal Framework for Property Taxation

- Future Trends in Property Taxation

Introduction to Travis County Property Tax Records

Travis County Texas property tax records play a crucial role in the local economy and governance. These records are maintained by the Travis Central Appraisal District (CAD) and provide detailed information about property assessments, ownership, and tax obligations. Property owners and potential buyers can access these records to gain insights into the value of properties and the associated tax liabilities.

Importance of Property Tax Records

Property tax records serve multiple purposes. They help in determining the fair market value of properties, ensuring equitable taxation, and providing transparency in the tax collection process. For homeowners, understanding these records is essential for budgeting and planning financial obligations.

Additionally, property tax records are vital for investors looking to assess the potential return on investment in Travis County real estate. By analyzing historical tax data, investors can make informed decisions about property purchases and sales.

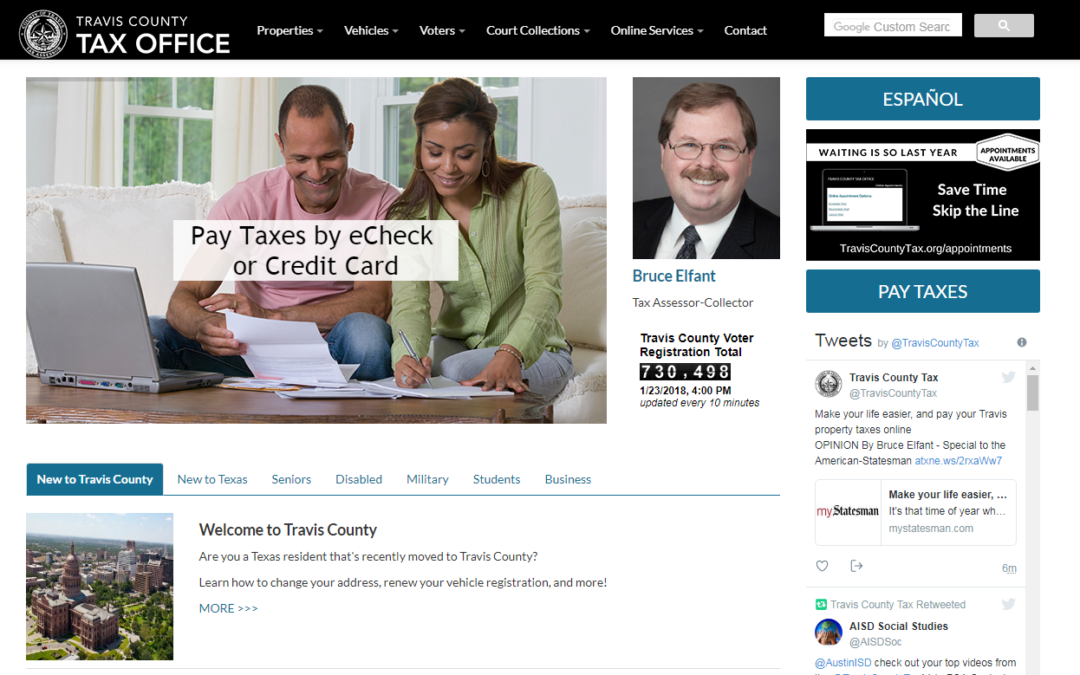

How to Access Travis County Texas Property Tax Records

Accessing Travis County Texas property tax records is relatively straightforward. The Travis Central Appraisal District provides an online portal where property owners and the general public can search for property tax information.

Steps to Access Property Tax Records

- Visit the Travis Central Appraisal District website.

- Use the property search tool to enter the address or parcel number of the property.

- Review the property details, including assessed value, ownership information, and tax history.

For those who prefer in-person access, the Travis CAD office offers assistance in retrieving property tax records. It is advisable to bring identification and any relevant property documents when visiting the office.

Understanding Property Tax Records in Travis County

Property tax records in Travis County contain a wealth of information that can be overwhelming for first-time users. Understanding the key components of these records is essential for making sense of the data.

Read also:Capital One Customer Service Number Your Ultimate Guide To Seamless Banking Support

Key Components of Property Tax Records

- Assessed Value: The estimated market value of the property used to calculate tax liability.

- Ownership Details: Information about the current owner, including name and contact information.

- Tax History: A record of past tax payments, exemptions, and any delinquencies.

By analyzing these components, property owners can gain a clear picture of their tax obligations and any potential issues that may arise.

Property Assessment Process

The property assessment process in Travis County is governed by state laws and local regulations. The Travis Central Appraisal District is responsible for assessing the value of all properties within the county. This process involves several steps to ensure accurate and fair assessments.

Steps in the Assessment Process

- Inspection: Appraisers conduct physical inspections of properties to gather data on size, condition, and features.

- Market Analysis: Appraisers analyze recent sales data and market trends to determine the fair market value of properties.

- Notification: Property owners receive a notice of their assessed value, which they can contest if they believe it is inaccurate.

Understanding the assessment process helps property owners prepare for potential changes in their tax liabilities and take appropriate action if needed.

Tax Exemptions and Deductions

Travis County offers several tax exemptions and deductions to eligible property owners. These incentives aim to reduce the tax burden on certain groups, such as seniors, disabled individuals, and veterans.

Common Tax Exemptions

- Homestead Exemption: Reduces the taxable value of a primary residence for homeowners.

- Over 65 Exemption: Provides additional tax relief for homeowners aged 65 and older.

- Disabled Veterans Exemption: Offers tax breaks to veterans with service-related disabilities.

Eligible property owners should apply for these exemptions to take full advantage of the available benefits and reduce their tax liabilities.

Appealing Property Tax Assessments

Property owners who believe their assessments are inaccurate have the right to appeal. The appeal process involves submitting a formal request to the Travis Central Appraisal District and providing evidence to support the claim.

Steps to Appeal a Property Tax Assessment

- File a protest with the Travis CAD by the specified deadline.

- Gather documentation, such as comparable sales data and property condition reports, to support your case.

- Attend a hearing with the Appraisal Review Board to present your appeal.

Successfully appealing an assessment can result in a reduced tax liability, making it a valuable option for property owners who feel their assessments are unfair.

Managing Tax Delinquency

Tax delinquency occurs when property owners fail to pay their property taxes on time. In Travis County, delinquent taxes accrue penalties and interest, which can significantly increase the total amount owed.

Steps to Resolve Tax Delinquency

- Contact the Travis CAD to discuss payment options, such as installment plans or settlements.

- Pay the outstanding balance as soon as possible to avoid further penalties.

- Stay informed about future tax due dates to prevent future delinquencies.

Managing tax delinquency promptly is crucial to avoid legal consequences, such as property liens or foreclosure.

How Property Taxes Fund Public Services

Property taxes in Travis County are a vital source of funding for public services. These funds support essential services, including education, public safety, healthcare, and infrastructure development.

Key Areas Funded by Property Taxes

- Education: Property taxes provide the majority of funding for public schools in Travis County.

- Public Safety: Funds support law enforcement, fire departments, and emergency medical services.

- Infrastructure: Property taxes finance road maintenance, public transportation, and other infrastructure projects.

Understanding how property taxes contribute to these services helps property owners appreciate the value they receive in return for their tax payments.

Legal Framework for Property Taxation

The legal framework governing property taxation in Travis County is established by state and local laws. The Texas Property Tax Code sets the guidelines for property assessment, taxation, and appeals. Local ordinances further define the specific procedures and requirements for property tax administration in Travis County.

Key Legal Provisions

- Equal and Uniform Taxation: Property taxes must be assessed equally and uniformly across all properties.

- Due Process: Property owners have the right to appeal their assessments and receive fair treatment in the tax system.

- Transparency: Tax records and assessment data must be accessible to the public to ensure accountability.

Staying informed about the legal framework helps property owners navigate the property tax system and protect their rights.

Future Trends in Property Taxation

The property tax landscape in Travis County is evolving with changes in technology, demographics, and economic conditions. Emerging trends in property taxation include the use of advanced data analytics, increased transparency through digital platforms, and efforts to address inequities in the tax system.

Potential Future Developments

- Implementation of smart technology to enhance property assessment accuracy.

- Expansion of online services for easier access to tax records and payment options.

- Reforms to address disparities in property tax burdens among different communities.

Staying informed about these trends will help property owners and stakeholders adapt to the changing property tax environment in Travis County.

Kesimpulan

Travis County Texas property tax records are a vital component of the local real estate and tax systems. By understanding how to access and interpret these records, property owners and investors can make informed decisions about their properties and financial obligations. The assessment process, tax exemptions, and legal framework all play a crucial role in shaping the property tax landscape in Travis County.

We encourage readers to explore the resources provided by the Travis Central Appraisal District and stay updated on the latest developments in property taxation. To further engage with this topic, please leave your comments or questions below, share this article with others who may find it useful, and explore our other resources on property taxes and real estate in Texas.