The State of Montana Dept of Revenue plays a pivotal role in managing the financial health of the state. As one of the essential government agencies, it handles tax collection, revenue management, and regulatory compliance. This department ensures that funds are appropriately collected and allocated to support public services and infrastructure development.

Montana's Department of Revenue is more than just a tax collection entity. It acts as a guardian of the state's financial stability by enforcing policies and regulations that govern revenue generation and distribution. Whether you're a business owner, taxpayer, or simply a resident of Montana, understanding the functions of this department can significantly impact your financial decisions.

Through this article, we will delve into the various aspects of the State of Montana Dept of Revenue, including its structure, responsibilities, and the services it offers. Whether you're seeking information on tax forms, vehicle registration, or property assessments, this guide will provide you with all the necessary details to navigate the department's operations effectively.

Read also:Santa Clarita Population 2023 An Indepth Analysis And Insights

Table of Contents

- History and Establishment of the State of Montana Dept of Revenue

- Organizational Structure of the Department

- Tax Collection and Management

- Vehicle Services and Registration

- Property Assessment and Taxation

- Business and Professional Licensing

- Regulatory Compliance and Enforcement

- Resources for Taxpayers and Businesses

- Challenges Faced by the Department

- Future Directions and Initiatives

History and Establishment of the State of Montana Dept of Revenue

Early Beginnings

The State of Montana Dept of Revenue was established to manage the financial systems of the state efficiently. Its origins can be traced back to the early days of Montana's statehood when the need for a centralized revenue collection system became apparent. The department was officially formed to streamline the process of tax collection and ensure that funds were used for public welfare.

In its early years, the department focused primarily on property taxes and liquor licensing. As the state's economy grew, so did the responsibilities of the department, expanding into areas such as income tax, vehicle registration, and business licensing.

Organizational Structure of the Department

Divisions and Offices

The State of Montana Dept of Revenue is organized into several divisions and offices, each with specific responsibilities. These include the Tax Division, Motor Vehicle Division, Licensing Division, and Legal Division. Each division is tasked with overseeing different aspects of revenue generation and management.

- Tax Division: Handles income tax, sales tax, and other tax-related matters.

- Motor Vehicle Division: Manages vehicle registration and titling.

- Licensing Division: Oversees business and professional licensing.

- Legal Division: Ensures compliance with state and federal regulations.

Tax Collection and Management

Types of Taxes Managed

The State of Montana Dept of Revenue is responsible for collecting various types of taxes, including income tax, sales tax, and excise tax. Each tax type serves a unique purpose in generating revenue for the state.

Income tax is levied on individuals and businesses to fund public services. Sales tax is applied to goods and services purchased within the state, while excise tax targets specific products like fuel and tobacco. The department ensures that these taxes are collected accurately and efficiently, minimizing the burden on taxpayers.

Vehicle Services and Registration

Vehicle Registration Process

Vehicle registration is one of the key services offered by the State of Montana Dept of Revenue. Residents must register their vehicles to obtain a license plate and ensure compliance with state laws.

Read also:Dancing With The Stars Voting A Comprehensive Guide To Boost Your Favorite Stars

The registration process involves submitting the necessary documentation, paying the required fees, and ensuring that the vehicle meets safety and emissions standards. The department provides online resources to simplify this process, allowing residents to complete their registration conveniently from home.

Property Assessment and Taxation

How Property Taxes Are Calculated

Property assessment and taxation are critical functions of the State of Montana Dept of Revenue. Property taxes are calculated based on the assessed value of the property and the mill levy set by local governments.

The department conducts regular assessments to ensure that property values are accurately reflected. This ensures that property owners pay their fair share of taxes, which are used to fund schools, infrastructure, and other public services.

Business and Professional Licensing

Requirements for Business Licensing

Business and professional licensing is another important responsibility of the State of Montana Dept of Revenue. Businesses operating within the state must obtain the appropriate licenses to ensure compliance with state regulations.

The licensing process involves submitting an application, paying fees, and meeting specific criteria related to the business type. The department provides resources and support to help businesses navigate this process successfully.

Regulatory Compliance and Enforcement

Enforcing State and Federal Regulations

The State of Montana Dept of Revenue plays a crucial role in enforcing state and federal regulations related to revenue generation and management. This includes ensuring that businesses and individuals comply with tax laws, licensing requirements, and other financial regulations.

The department employs a team of auditors and investigators to monitor compliance and address any violations. By enforcing these regulations, the department helps maintain the financial integrity of the state.

Resources for Taxpayers and Businesses

Online Tools and Support

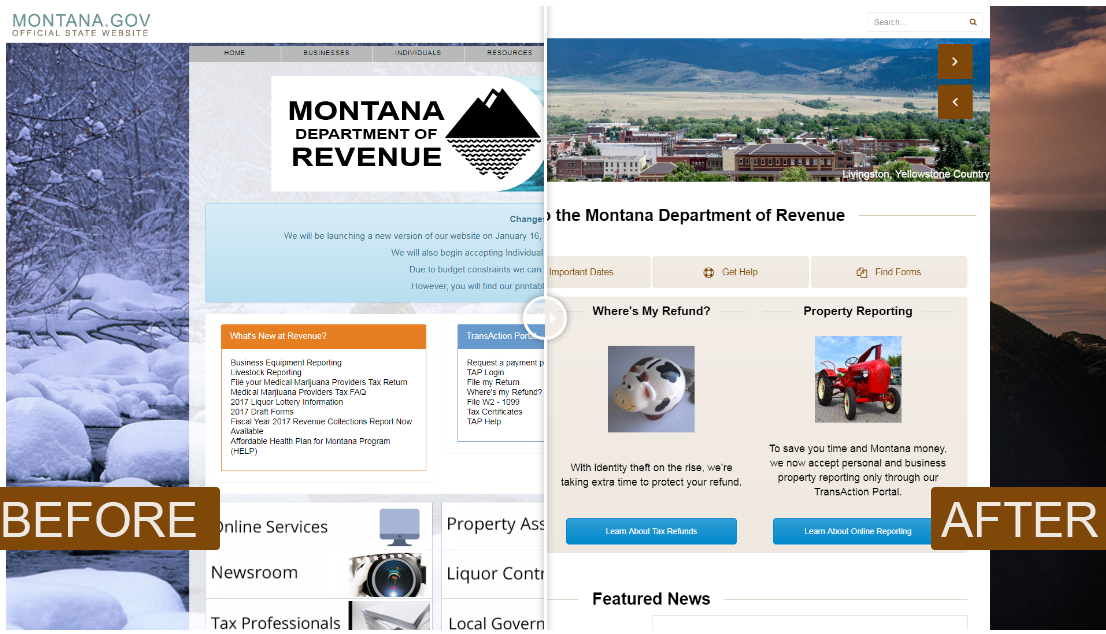

The State of Montana Dept of Revenue offers a range of resources to assist taxpayers and businesses in managing their financial obligations. These include online tools for tax filing, payment processing, and license applications.

Additionally, the department provides educational materials and customer support to help individuals and businesses understand their responsibilities and rights. These resources are designed to make the process of interacting with the department as seamless as possible.

Challenges Faced by the Department

Addressing Financial and Administrative Challenges

Like any government agency, the State of Montana Dept of Revenue faces various challenges in fulfilling its mission. These include managing budget constraints, adapting to changing regulations, and addressing taxpayer concerns.

The department continuously seeks innovative solutions to overcome these challenges, such as implementing new technologies and improving customer service. By staying proactive, the department aims to enhance its effectiveness and efficiency in serving the public.

Future Directions and Initiatives

Innovative Approaches to Revenue Management

The State of Montana Dept of Revenue is committed to exploring new approaches to revenue management that benefit both the state and its residents. This includes adopting advanced technologies, enhancing transparency, and fostering collaboration with other government agencies.

Looking ahead, the department plans to launch initiatives aimed at improving taxpayer experience, increasing efficiency, and ensuring long-term financial stability for the state. These efforts will help the department remain a leader in revenue management and public service.

Conclusion

The State of Montana Dept of Revenue is an essential component of the state's financial infrastructure. By managing tax collection, vehicle services, property assessment, and business licensing, the department ensures that funds are appropriately allocated to support public services and infrastructure development.

We encourage readers to take advantage of the resources and services offered by the department to manage their financial obligations effectively. If you have any questions or need further assistance, please leave a comment or share this article with others who may benefit from the information provided. Together, we can support the financial health and prosperity of the great state of Montana.

Data Source: Montana Department of Revenue