Understanding what a bank's ABA number is can make banking transactions smoother and more efficient. Whether you're setting up direct deposits, wiring money, or issuing checks, knowing your bank's ABA routing number is essential. This article delves into the details of ABA numbers, their significance, and how they work in banking processes.

In today's fast-paced world, financial transactions happen at lightning speed. However, behind the scenes, specific codes and numbers ensure that money reaches the right accounts. One of these crucial numbers is the ABA routing number. This article will explore what it is, its importance, and how it impacts various banking operations.

By the end of this guide, you will have a thorough understanding of bank ABA numbers and how to use them effectively in your financial activities. Let’s dive in.

Read also:Is Jo Frost Married Exploring The Personal Life Of The Renowned Parenting Expert

Table of Contents

- What is a Bank's ABA Number?

- The Purpose of ABA Numbers

- ABA Number Format and Structure

- ABA Number vs. SWIFT Code

- How ABA Numbers Are Used

- How to Find Your Bank's ABA Number

- Security Concerns with ABA Numbers

- The History of ABA Numbers

- ABA Number Changes and Updates

- Conclusion

What is a Bank's ABA Number?

A bank's ABA number, also known as the American Bankers Association routing number, is a nine-digit code assigned to financial institutions in the United States. It serves as a unique identifier for banks and credit unions, ensuring that funds are routed to the correct institution during transactions.

This number plays a critical role in various banking activities, such as wire transfers, direct deposits, and check processing. Without an accurate ABA number, transactions could be delayed or even fail.

Why is the ABA Number Important?

- Ensures accurate routing of funds

- Facilitates seamless electronic transactions

- Reduces errors in financial operations

The Purpose of ABA Numbers

The primary purpose of an ABA number is to identify the financial institution involved in a transaction. It helps ensure that money is transferred to the correct bank or credit union, preventing misrouting and errors.

Additionally, ABA numbers are used in various banking processes, including:

- Direct deposits of paychecks

- Automated Clearing House (ACH) transactions

- Check clearing and processing

ABA Number Format and Structure

An ABA number consists of nine digits and follows a specific format. The first four digits represent the Federal Reserve Routing Symbol, which identifies the Federal Reserve Bank servicing the financial institution. The next four digits are the ABA Institution Identifier, which uniquely identifies the bank or credit union. The final digit is a check digit, used to validate the routing number.

For example, an ABA number might look like this: 123456789.

Read also:Vinicius Jr Stats This Season An Indepth Analysis Of His Performance

How to Validate an ABA Number

To validate an ABA number, you can use the following formula:

- Multiply the first digit by 3

- Multiply the second digit by 7

- Multiply the third digit by 1

- Repeat this process for all nine digits

- Add the results together; the sum should be divisible by 10

ABA Number vs. SWIFT Code

While both ABA numbers and SWIFT codes are used in banking transactions, they serve different purposes and are used in different contexts.

An ABA number is primarily used for domestic transactions within the United States, whereas a SWIFT code is used for international transactions. SWIFT codes are alphanumeric and consist of 8-11 characters, providing more detailed information about the bank and its location.

Key Differences Between ABA and SWIFT

- ABA numbers are numeric, while SWIFT codes are alphanumeric

- ABA numbers are used for domestic transactions, while SWIFT codes are used for international transactions

- ABA numbers are nine digits, while SWIFT codes are 8-11 characters

How ABA Numbers Are Used

ABA numbers are integral to various banking operations. Here are some of the most common uses:

Direct Deposits

When setting up direct deposits for paychecks or government benefits, you will need to provide your bank's ABA number. This ensures that the funds are deposited into the correct account.

Wire Transfers

For domestic wire transfers, an ABA number is required to ensure that the funds are sent to the correct bank. Without the correct ABA number, the transfer could be delayed or sent to the wrong institution.

Check Processing

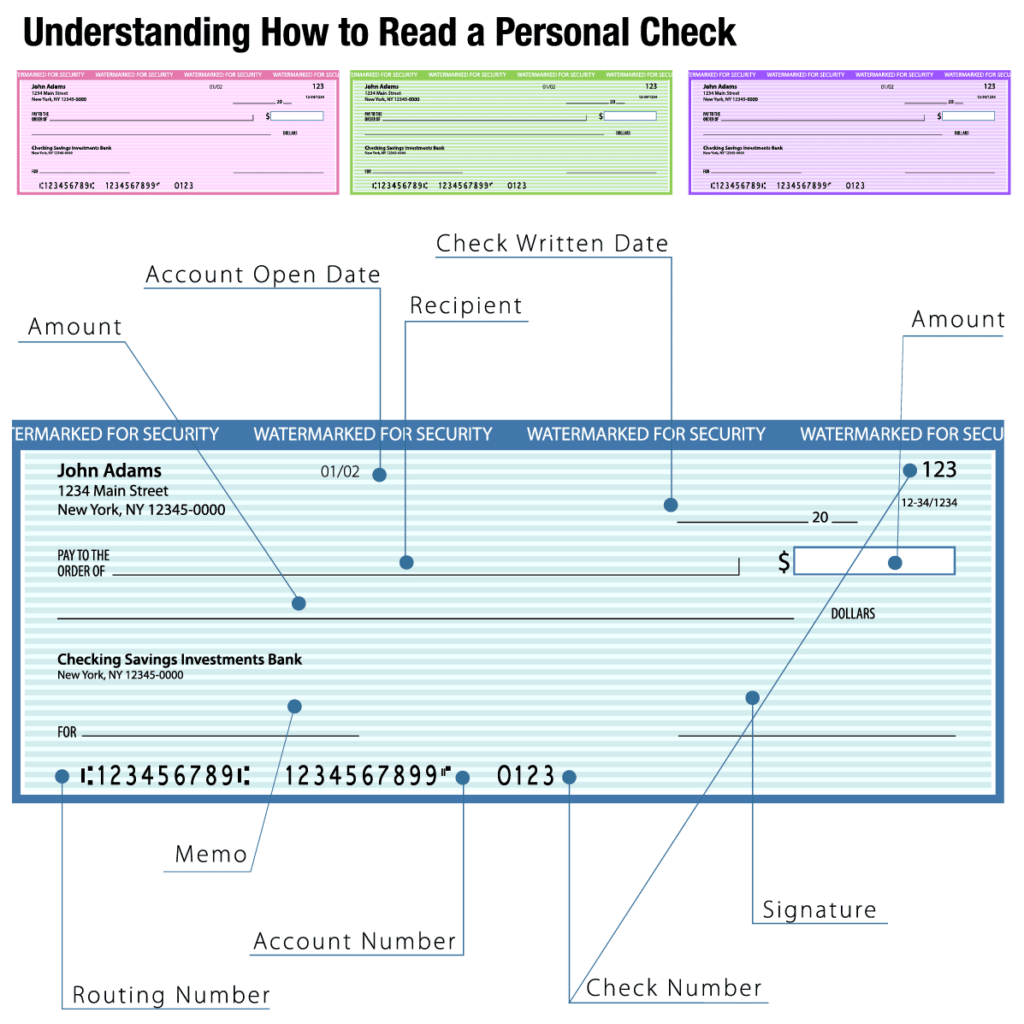

When you write a check, the ABA number is printed on the bottom of the check. This number helps banks process the check and route the funds to the correct institution.

How to Find Your Bank's ABA Number

Finding your bank's ABA number is relatively straightforward. Here are some methods you can use:

Check Your Bank Statements

Your bank's ABA number is often printed on your monthly bank statements. Look for a nine-digit number labeled as the routing number.

Visit Your Bank's Website

Most banks provide their ABA numbers on their official websites. Simply search for "routing number" on your bank's site to find it.

Contact Your Bank

If you're unable to locate your bank's ABA number, you can contact your bank's customer service department for assistance. They will be able to provide you with the correct routing number.

Security Concerns with ABA Numbers

While ABA numbers are essential for banking transactions, they can also pose security risks if they fall into the wrong hands. Scammers may use ABA numbers to create fake checks or attempt unauthorized transactions.

To protect yourself, it's important to keep your ABA number confidential and only share it with trusted parties. Additionally, monitor your bank account regularly for any suspicious activity.

Best Practices for Protecting Your ABA Number

- Do not share your ABA number publicly

- Use secure methods to transmit your ABA number

- Regularly review your bank statements for discrepancies

The History of ABA Numbers

The ABA numbering system was introduced in 1910 by the American Bankers Association (ABA) to streamline banking operations. Before the introduction of ABA numbers, banks relied on manual processes to route checks and funds, which were time-consuming and prone to errors.

Over the years, the ABA numbering system has evolved to accommodate advancements in technology and changes in the banking industry. Today, ABA numbers are a crucial component of modern banking infrastructure.

ABA Number Changes and Updates

ABA numbers are occasionally updated or changed due to mergers, acquisitions, or other organizational changes within financial institutions. If your bank undergoes a change, it's important to update your records with the new ABA number to avoid disruptions in your banking activities.

Keep an eye on communications from your bank regarding any changes to their ABA number. They will typically notify customers well in advance to ensure a smooth transition.

Conclusion

Understanding what a bank's ABA number is and how it works is essential for anyone involved in banking transactions. From direct deposits to wire transfers, ABA numbers play a vital role in ensuring that funds are routed accurately and efficiently.

By following the tips and best practices outlined in this guide, you can ensure that your banking activities run smoothly and securely. If you have any questions or need further clarification, feel free to leave a comment below or explore other articles on our site for more information.

We invite you to share this article with others who may find it helpful and encourage you to explore related topics to deepen your understanding of banking and finance.