The MT Department of Revenue plays a crucial role in managing and regulating Montana's financial systems. As a vital government agency, it ensures that all state tax laws are followed and that revenue is collected efficiently. This department is responsible for various tax-related activities, including property taxes, vehicle registration, and business licenses.

Montana residents and businesses must stay informed about the functions of the MT Department of Revenue to ensure compliance with state regulations. Understanding the department's responsibilities and services helps taxpayers avoid penalties and take advantage of available resources.

This article provides a detailed overview of the MT Department of Revenue, including its history, services, and key programs. Whether you're a taxpayer, business owner, or simply curious about Montana's tax authority, this guide will offer valuable insights into how the department operates and affects daily life.

Read also:Understanding The Security And Functionality Of Https Aka Ms Remoteconnect Com

Table of Contents

- History of MT Department of Revenue

- Key Functions and Responsibilities

- Types of Taxes Administered

- Revenue Collection Process

- Business Services Offered

- Resources for Taxpayers

- Ensuring Tax Compliance

- Tax Appeal Process

- Use of Technology in Operations

- Future Plans and Initiatives

History of MT Department of Revenue

The Montana Department of Revenue (MT DOR) was established to manage the state's tax system and ensure compliance with tax laws. Founded in the early 20th century, the department has evolved significantly over the years to meet the growing needs of Montana's population and economy. Initially focused on collecting property taxes, the MT Department of Revenue now oversees a wide range of tax-related activities, including income tax, sales tax, and vehicle registration.

Early Beginnings

In the early days, the department's primary focus was on property tax assessment and collection. As Montana's economy diversified, the need for a more comprehensive tax system became apparent. This led to the expansion of the department's responsibilities to include other forms of taxation, such as income and sales taxes.

Modern Developments

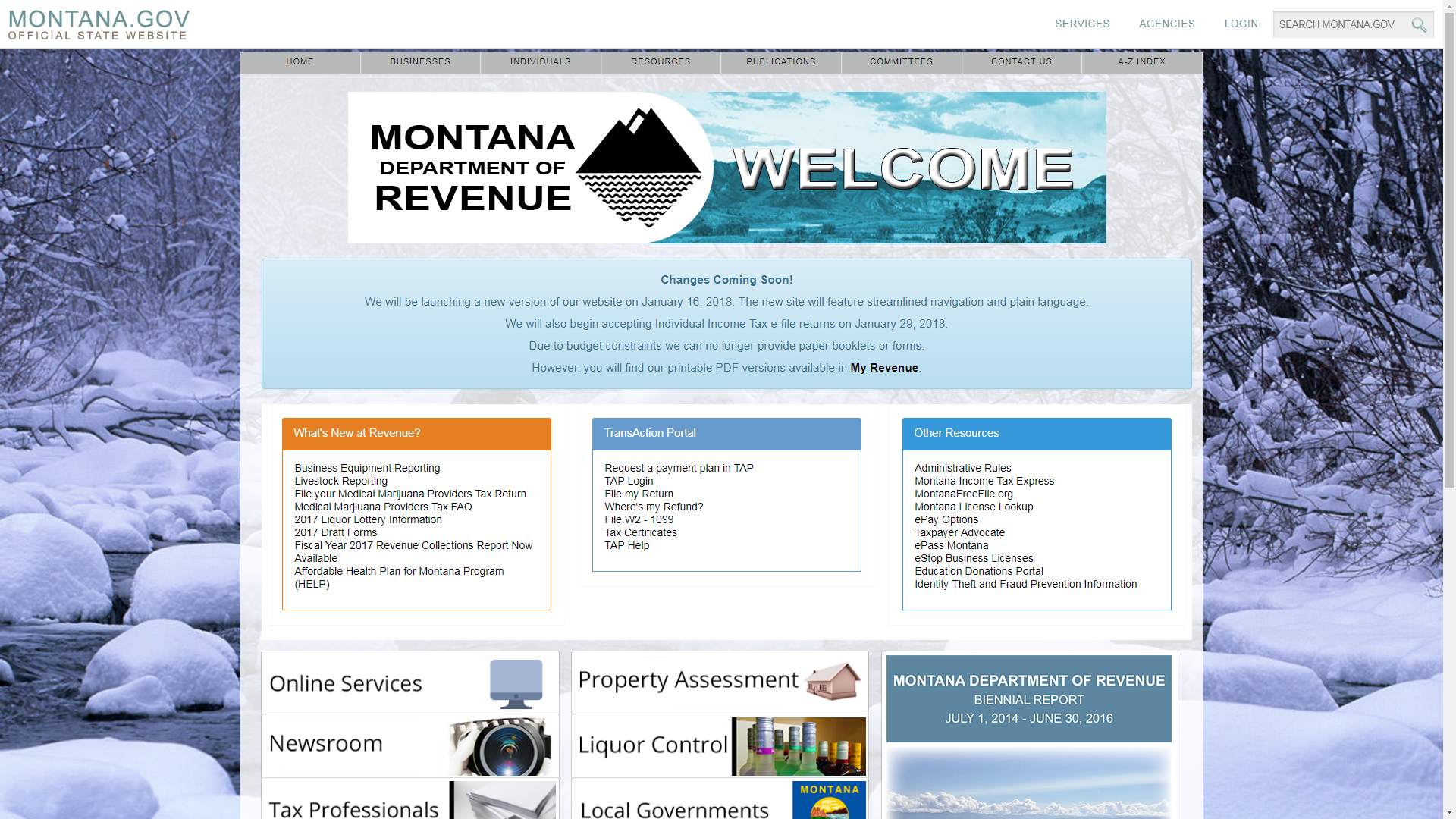

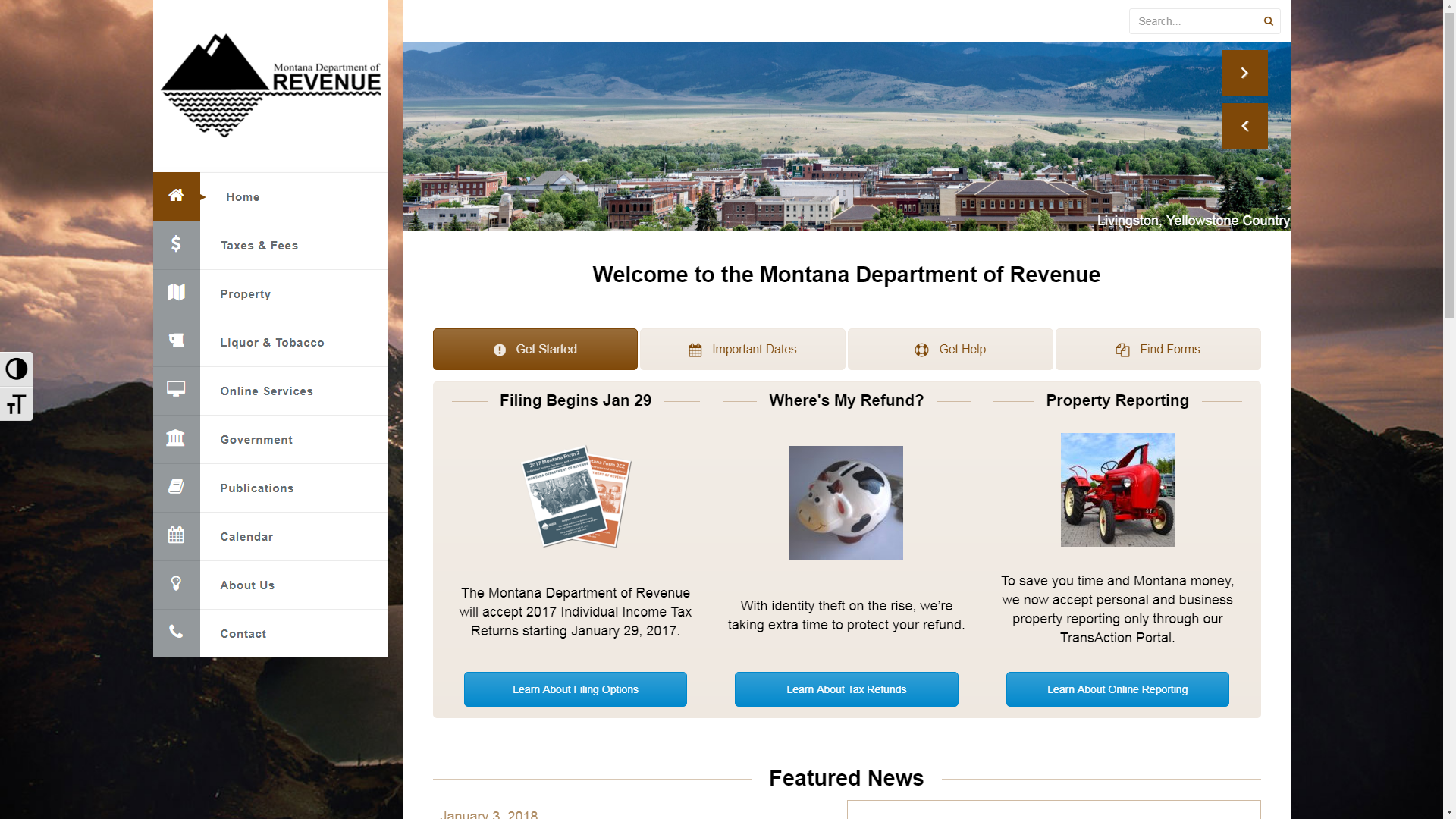

Today, the MT Department of Revenue utilizes advanced technology and data analytics to streamline operations and improve taxpayer services. The department continues to adapt to changing economic conditions and legislative requirements, ensuring that it remains a key player in Montana's financial landscape.

Key Functions and Responsibilities

The MT Department of Revenue performs several critical functions to support Montana's economy and government operations. These functions include tax administration, revenue collection, and regulatory oversight. By fulfilling these responsibilities, the department ensures that state funds are collected efficiently and used for public benefit.

Read also:Madden Nfl 24 Xbox One The Ultimate Guide To Mastering The Game

- Administering state tax laws

- Collecting revenue from various sources

- Providing taxpayer assistance and education

- Ensuring compliance with tax regulations

- Offering business services and licensing

Regulatory Oversight

One of the department's primary roles is to enforce state tax laws and regulations. This involves monitoring taxpayer activities, conducting audits, and addressing non-compliance issues. Through these efforts, the MT Department of Revenue helps maintain a fair and equitable tax system for all Montanans.

Types of Taxes Administered

The MT Department of Revenue administers several types of taxes, each designed to address specific aspects of Montana's economy and society. These include property taxes, income taxes, sales taxes, and excise taxes. Understanding these tax categories is essential for individuals and businesses seeking to comply with state regulations.

Property Taxes

Property taxes are one of the primary sources of revenue for Montana's local governments. The MT Department of Revenue works with counties and municipalities to assess property values and collect taxes. These funds are used to support public services such as education, infrastructure, and emergency response.

Income Taxes

Montana's individual income tax is administered by the MT Department of Revenue, which calculates tax liability based on a progressive rate structure. Businesses operating in the state are also subject to corporate income tax, ensuring that all economic entities contribute to the state's revenue base.

Revenue Collection Process

The revenue collection process managed by the MT Department of Revenue involves several steps, from tax assessment to payment processing. This systematic approach ensures that funds are collected efficiently and accurately, minimizing errors and delays.

Tax Assessment

Before collecting taxes, the department must first assess the amount owed by individuals and businesses. This involves evaluating property values, income levels, and other relevant factors. Once assessments are complete, taxpayers receive notices outlining their obligations and payment deadlines.

Payment Processing

Taxpayers can submit payments through various methods, including online portals, mail, and in-person transactions. The MT Department of Revenue processes these payments promptly, ensuring that funds are allocated to appropriate accounts and programs.

Business Services Offered

The MT Department of Revenue provides numerous services to support Montana's business community. These include licensing, registration, and tax assistance programs. By offering these resources, the department helps businesses operate efficiently and remain compliant with state regulations.

- Business license registration

- Sales tax permits

- Employer withholding tax accounts

- Online filing and payment options

Online Services

To enhance convenience and accessibility, the MT Department of Revenue offers a range of online services for businesses. These include electronic filing, payment processing, and account management tools. By leveraging technology, the department simplifies the tax compliance process for businesses of all sizes.

Resources for Taxpayers

The MT Department of Revenue provides a wealth of resources to assist taxpayers in understanding and complying with state tax laws. These resources include publications, workshops, and customer service support. By utilizing these tools, taxpayers can ensure that they meet their obligations and take advantage of available benefits.

Publications

The department publishes various guides and manuals to educate taxpayers about their rights and responsibilities. These materials cover topics such as tax forms, filing deadlines, and deduction opportunities. Taxpayers can access these publications online or request physical copies from the department.

Workshops and Seminars

To further support taxpayer education, the MT Department of Revenue hosts workshops and seminars throughout the year. These events provide valuable insights into tax laws and regulations, helping individuals and businesses stay informed and compliant.

Ensuring Tax Compliance

Tax compliance is a critical aspect of the MT Department of Revenue's mission. The department employs various strategies to encourage and enforce compliance, including audits, penalties, and educational initiatives. By promoting a culture of compliance, the department helps ensure that all taxpayers contribute fairly to Montana's revenue base.

Audits

Audits are an essential tool used by the MT Department of Revenue to verify taxpayer compliance with state tax laws. During an audit, department officials review financial records and transactions to identify discrepancies or errors. Taxpayers are encouraged to cooperate fully with audit requests to resolve issues efficiently.

Tax Appeal Process

Taxpayers who disagree with decisions made by the MT Department of Revenue have the right to appeal. The department provides a structured appeal process to address taxpayer concerns and resolve disputes fairly and impartially. Understanding this process is crucial for individuals and businesses seeking to challenge tax assessments or penalties.

Steps in the Appeal Process

The tax appeal process typically involves several stages, including informal review, formal hearing, and potential judicial review. Taxpayers must follow specific procedures and deadlines to ensure their appeals are considered appropriately. The MT Department of Revenue offers guidance and support throughout this process to help taxpayers navigate it successfully.

Use of Technology in Operations

The MT Department of Revenue leverages advanced technology to enhance its operations and improve taxpayer services. From data analytics to online portals, the department utilizes innovative tools to streamline processes and increase efficiency. By embracing technology, the department remains at the forefront of modern tax administration.

Data Analytics

Data analytics plays a vital role in the MT Department of Revenue's operations, enabling the department to identify trends, detect anomalies, and forecast revenue. By analyzing large datasets, the department can make informed decisions and develop strategies to improve tax compliance and collection.

Future Plans and Initiatives

Looking ahead, the MT Department of Revenue has several plans and initiatives aimed at enhancing its services and operations. These include expanding online resources, improving customer service, and implementing new technologies. By pursuing these goals, the department aims to remain a leader in state tax administration and ensure that all Montanans benefit from its efforts.

Expanding Online Resources

To better serve taxpayers, the MT Department of Revenue plans to expand its online resources, offering more tools and services through its website. This includes enhanced mobile access, improved search functionality, and additional educational materials. By making these resources more accessible, the department hopes to increase taxpayer engagement and satisfaction.

Conclusion

The MT Department of Revenue plays a vital role in managing Montana's tax system and ensuring compliance with state regulations. By understanding the department's functions, services, and initiatives, taxpayers can better navigate the tax landscape and fulfill their obligations. Whether you're an individual or business owner, staying informed about the MT Department of Revenue's activities is essential for financial success and legal compliance.

We encourage you to explore the resources provided by the MT Department of Revenue and take advantage of the services offered. For further information or assistance, please visit their official website or contact their customer service team. Additionally, we invite you to share this article with others who may benefit from its insights and leave a comment below with your thoughts or questions.